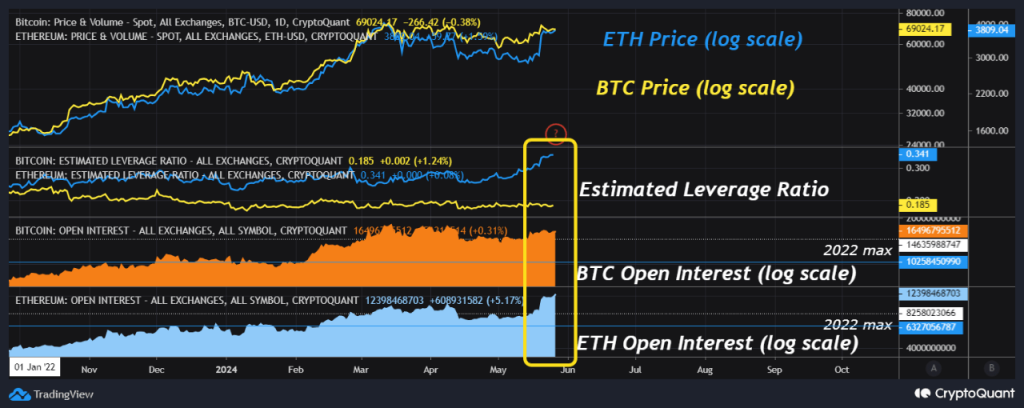

As the US Securities and Exchange Commission (SEC) approved all the spot Ethereum ETF applications, despite increased regulatory uncertainty surrounding the cryptocurrency, investors are becoming more optimistic about the potential for ETH’s price to reach new heights. Bullish Sentiment Surrounds Ethereum ETF Approval DeFiance Capital Founder and CIO Arthur Cheong predicts that ETH could reach an annual high of $4,500 before the newly approved index funds begin trading, surpassing its mid-March high of $4,096. This projection falls just short of ETH’s all-time high of $4,878 during the 2021 bull run. In addition, a survey conducted by WuBlockchain in the Chinese community revealed that 58% of respondents believe that ETH has the potential to rise to $10,000 or even higher in this market cycle. Related Reading: Kickstarting The Bitcoin Bull Run: Expert Says $70,000 Is The Level To Beat The recent regulatory pivot by the SEC towards approving Ether ETFs has intensified bets on further price gains. In the seven days following the announcement, ETH experienced a 26% surge, marking the largest weekly advance since the 2021 crypto bull market. This development brings hope to speculators, considering the success of US spot Bitcoin ETFs, which have amassed $59 billion in assets since their record-breaking debut in January. However, spot Ethereum ETFs will not participate in staking, earning rewards by pledging tokens to maintain the Ethereum blockchain. This omission could potentially dampen interest in these funds in comparison to holding the tokens directly. Although additional SEC approvals are required before issuers such as BlackRock and Fidelity Investments can launch their products, the timeline for these releases remains uncertain. As of now, ETH is trading around $3,900, with expectations of further upside potential. Options Bets Signal Potential Climb To $5,000 According to a Bloomberg report, analysts such as Pepperstone Group Head of Research Chris Weston believe that pullbacks in ETH are buying opportunities as the risk remains skewed to the upside. Interestingly, as seen in the chart below, some traders are placing bullish options bets, with concentrations signaling a potential climb to $5,000 or more. Furthermore, ETH’s volatility, as indicated by the T3 Ether Volatility Index, is expected to be greater than that of Bitcoin, highlighting the potential for larger price swings in the second-largest digital asset. Related Reading: Ripple CTO Addresses Curious Price Link Between XRP And XLM Insights from the futures market, particularly the level of open interest in Chicago Mercantile Exchange (CME) Ethereum futures, provide evidence of institutional demand for regulated exposure to cryptocurrencies. While open interest in CME Ether futures is growing, it remains significantly lower than that of CME Bitcoin futures. This suggests relatively less institutional exposure to Ether and could potentially impact initial inflows into Ether ETFs. Nevertheless, as the approval of Ethereum ETFs opens up new avenues for investment and speculation, the market is closely watching ETH’s price performance, with bullish sentiment and optimistic predictions prevailing among investors. Featured image from Shutterstock, chart from TradingView.com