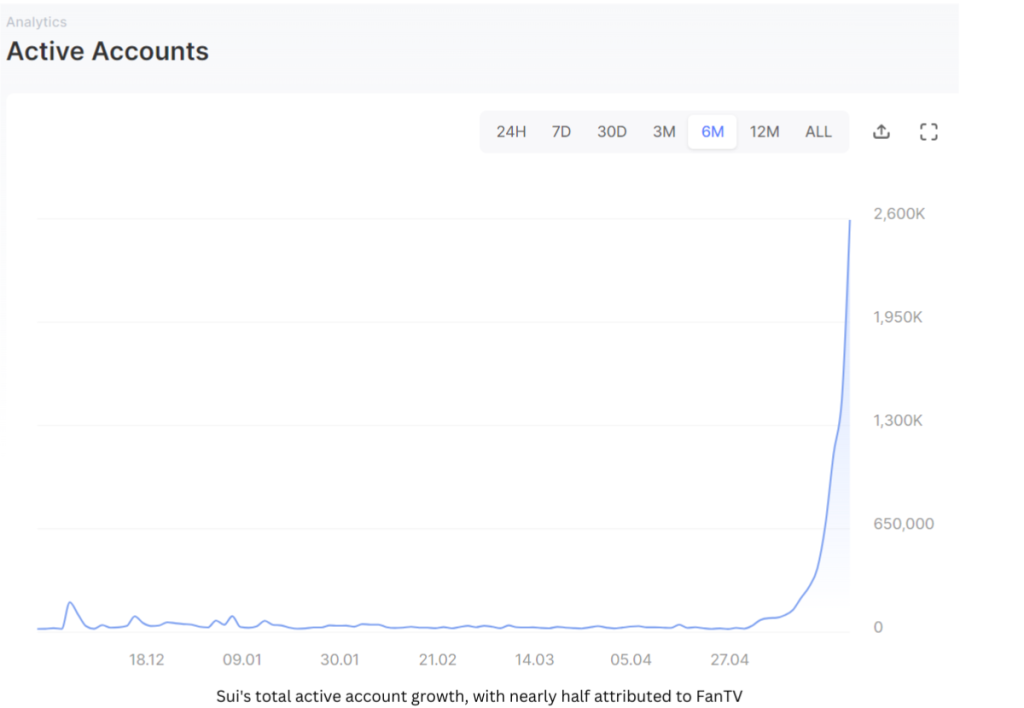

FanTV, fastest-growing socialFi dApp went live on Sui Mainnet last week Sui’s total active accounts ballooned by an impressive 2.6 million in the past week, with FanTV contributing 48% of this growth Dubai, 28 May 2024 – FanTV, a leading SocialFi platform empowering the Creator economy, announced today a major milestone of onboarding over 1 million new user accounts on Sui, the Layer 1 blockchain and smart contract platform. This achievement accounts for 48% of the 2.6 million wallet growth on Sui over the last week. This significant growth highlights the successful impact of integrating blockchain technology with social media platforms, enhancing user engagement and expanding the reach of decentralized networks. FanTV’s integration of Sui marks a pivotal step in the mainstream adoption of blockchain solutions in the content streaming landscape. Founded by Prashan Agarwal, ex-CEO of Gaana (one of India’s largest music streaming platforms that raised $115M from Tencent), FanTV with its unique Create / Watch to Earn offering is bringing the web2 user experience to the web3 ecosystem. FanTV allows Users and Creators to earn points for engagement and content creation on the platform. The earned points are then converted to the platform token and can be used for platform utility like promotion of content, tipping creators, buying creator keys, subscriptions, etc. FanTV has more than 4 million users and over 20,000 creators. FanTV’s inclusion brings significant growth, onboarding more than 1 million wallets to Sui, and solidifying its role in onboarding the masses to Web3. Prashan Agarwal, Founder and CEO, FanTV, expressed excitement about hitting this milestone, stating, “Partnering with Sui has enabled us to deliver even greater value to our users. As the fastest growing consumer social dApp, FanTV is committed to pioneering new frontiers in blockchain technology, user engagement and new avenues for creator monetization. This surge in established wallets is just the beginning of what we can achieve together. Our vision is to decentralize the creator economy and this is a good step in that direction.” “Thanks to FanTV’s recent integration of Sui, we’re able to see the truth of Sui’s tremendous capacity to handle dramatic upticks in wallets seamlessly, without any interruption to user experience,” said Greg Siourounis, Managing Director of Sui Foundation. “This massive growth is a testament to the power of collaboration and innovation, and we are excited to witness continued growth and adoption within the Sui ecosystem.” With this amazing feat, FanTV plans to shift its gear on global expansion and onboard over 100,000 creators and 10 million users in the next 12 months. For more information about FanTV, please visit https://fantv.world. About FanTV FanTV is the next-generation content creation platform, enabling everyone to create, consume, and get rewarded. The platform bridges the gap between traditional video streaming platforms and Web3-enabled video streaming experience. FanTV believes every person is creative, yet isn’t resourced well to create or get discovered in an ocean of centralized platforms and this leads to the incentivization of only the concentrated few. We seek to change that by arming everyone to be a Creator with all the tools that foster creativity enabled by advancements in AI and decentralize the ownership and discovery of content. FanTV’s vision is to attract the next billion users to Web3 by empowering the creator economy and democratizing content ownership. About Sui Sui is a first-of-its-kind Layer 1 blockchain and smart contract platform designed from the bottom up to make digital asset ownership fast, private, secure, and accessible to everyone. Based on the Move programming language, its object-centric model enables parallel execution, sub-second finality, and rich on-chain assets. With horizontally scalable processing and storage, Sui supports a wide range of applications with unrivaled speed at low cost. Sui is a step-function advancement in blockchain and a platform on which creators and developers can build amazing, user-friendly experiences. Learn more: https://sui.io Name – Prashan Agarwal Company Name – FanTV Email – ashish.kashyap@fantv.in Website – https://fantv.world/ Location Dubai UAE