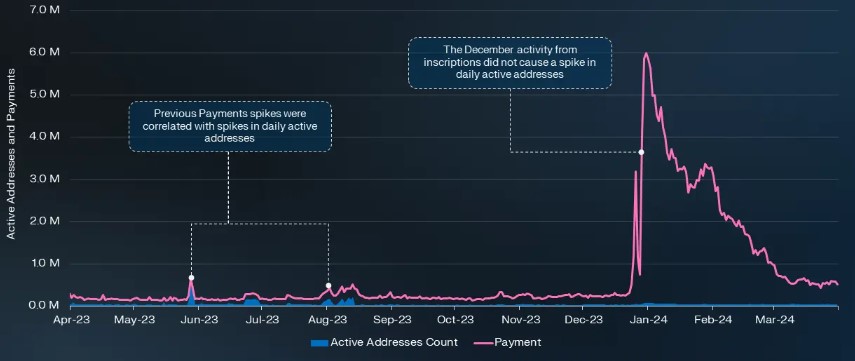

As a recent Messari report outlined, the XRP Ledger (XRPL) showcased notable progress during the first quarter of 2024. The decentralized public blockchain, which facilitates the transfer of XRP, fiat currencies, and other digital assets, has demonstrated substantial activity. XRP Ledger Burn Rate Slows Amid Low Fees During Q1 2024, XRP, the native token of the XRPL, secured its position as the sixth largest cryptocurrency by market capitalization, reaching $34.1 billion (currently $29M). Despite a slight price decrease, XRP’s circulating market cap witnessed a 1.3% growth quarter-over-quarter (QoQ). Related Reading: Forget Fear, Embrace Greed? Bitcoin Soars As Sentiment Turns Red Hot The XRPL employs a deflationary mechanism by systematically burning transaction fees. This process exerts downward pressure on the total supply of XRP, which stands at 100 billion tokens. Since the inception of the XRP Ledger, approximately 12 million XRP have been burned. However, the low burn rate during Q1 can be attributed to the network’s relatively low transaction fees (less than $0.002 per transaction). Additionally, 1 billion XRP is released from escrow to Ripple each month, with any unutilized tokens being placed into new escrow contracts. This pattern will continue until the remaining approximately 45 billion XRP becomes liquid; at this point, the deflationary pressure from burned fees will be the primary variable affecting supply. While XRP’s price decreased marginally 0.1% QoQ, lagging behind the overall crypto market’s 63.0% increase, it rose 14.8% year over year (YoY). Inscription-Fueled Transactions Propel XRPL Daily Payments The report highlights that revenue in the XRPL is measured as total fees collected by the network, which are subsequently burned, contributing to the redistribution of wealth from transaction fee spenders to XRP holders. Network activity showed significant growth, with active addresses and transactions increasing by 37% and 113% QoQ, respectively. A substantial portion of transaction activity on the XRPL stemmed from inscriptions, a transaction type popularized in early 2023. Over 30 million transactions were sent to a single account by approximately 45,000 accounts engaged in inscription-related activities. According to Messari, inscriptions, facilitated by XRP Script, played a key role in driving the surge in daily payments, which soared 350% QoQ to 2 million transactions. Related Reading: $2.9 Billion In Mt. Gox Bitcoin On The Move For The First Time In 5 Years, Where Is It Headed? Lastly, the report notes that the XRP Ledger blockchain witnessed a net increase of 150,000 accounts, driving the total number of accounts up by 3.1% to 5.15 million in Q1. However, new addresses decreased 12.4% QoQ to 183,000, primarily due to the high number of addresses created in Q4, coinciding with the inception of inscription activity. As of press time, XRP is valued at $0.5279, down 2.5% in the past 24 hours and 3.5% in the past seven days, which is in line with the broader market trend. Featured image from Shutterstock, chart from TradingView.com