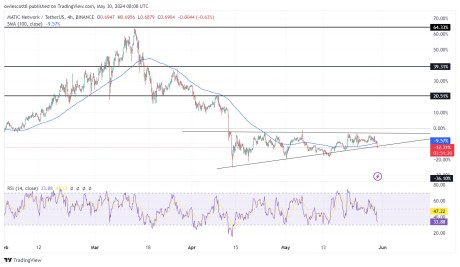

For a while now, the price of MATIC has been in a consolidation zone, moving between $0.7730 and $0.6233, forming a bearing triangle flag in the process. This is a result of the drop from its high of $0.9288 that happened days ago which led to MATIC dropping by over 25%. Although the price of MATIC is still consolidating, it is building up momentum for a potential breakout. So taking a trade at this point is not advisable until a breakout occurs which can be either above the consolidation zone or below it. In this article, we will dive into the possible price actions when a potential breakout from the consolidation occurs. Lately, MATIC’s price and market cap have dropped, suggesting that the bulls may be waiting out this spike. As of the time of writing, MATIC’s price was down by 2.97%, trading around $0,6926 below the 100-day Simple Moving Average (SMA) in the last 24 hours. Its market capitalization has decreased by over 5% in the past day to $6.91 billion. Meanwhile, its trading volume has risen to $374 million, indicating a more than 1% increase in the past day. MATIC On The 4-hour Chart Looking at the 4-hour timeframe chart, MATIC is attempting to break below the 100-day moving average, suggesting that prices might break below the consolidation zone and move bearishly. Also, using the Relative Strength Index (RSI) to analyze the price action in the 4-hour timeframe, we can see that the RSI line has crossed below the 50% level, heading toward the oversold zone, suggesting that the price might break below the consolidation zone. Meanwhile, in the daily time frame, it can also be observed that the price attempts to break below the bearish triangle out of the consolidation zone below the 100-day simple moving average. The 1-day RSI also suggests that the price of MATIC might break below the consolidation as the RSI signal line has broken below the 50% level and is heading toward the oversold zone. Specifically, this indicates that sellers weaken buyers in the market. With this strength of the sellers in the market, MATIC will continue to move downward when there is a break out below the consolidation zone. Potential Price Actions In The Event Of A Breakout Conclusively, if there is a break out above the consolidation zone, MATIC will continue to move upward toward the $0.9488 resistance level. If the price breaks this resistance level, it could rise even higher to test the resistance level of $1.0968. On the contrary, should MATIC’s price break below the consolidation zone, in continuation of its downtrend the price might begin to move toward the $0.5030 support level. It might continue to move downward toward the 0.3132 support level if the price breaks below this level. Featured image from Adobe Stock, chart from Tradingview.com