Bitcoin Takes The Lead As Crypto Funds See Third Straight Week Of Inflows

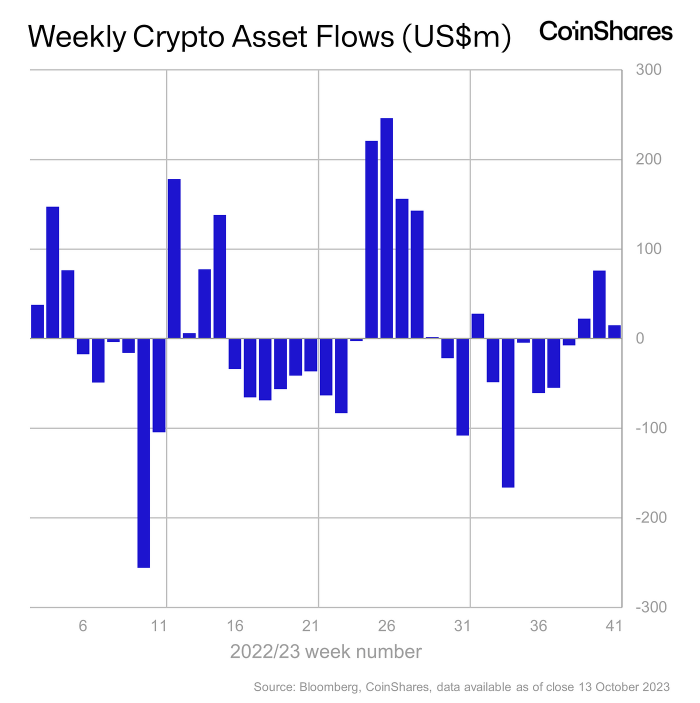

Despite an array of uncertainties that have dotted the crypto horizon, recent data from Coinshares reveals a continuous faith in the sector, especially the foremost crypto giant, Bitcoin. Digital asset investment products have seen a steady and positive trend, recording net inflows for three weeks. Amid these inflows, Bitcoin emerges as the most dominant, presenting a robust case for its standing in the market. Related Reading: Will October Be Bitcoin’s Golden Month Again? A Dive Into A Decade Of Bullish Trends Bitcoin Steers The Inflow Wave According to the latest report by CoinShares, Bitcoin-centric products experienced inflows amounting to $16 million just in the past week. This surge has swelled the year-to-date inflows, positioning them at $260 million. CoinShares’ data also shed light on inflows into Short-Bitcoin funds, which amounted to $1.7 million. However, the report reveals that the recent data might not reflect the aftermath of the SEC’s decision not to appeal against the Grayscale legal challenge. James Butterfill, the Head of Research at CoinShares, noted: It is worth noting that our data, which is as of Friday’s close, was unlikely to capture the positive news out of the US regarding the SEC not appealing the Grayscale legal challenge, potentially paving the way for a spot-based ETF in the US. While Bitcoin held its ground, other cryptocurrencies also showcased noteworthy movements. Solana’s investment products added roughly $3.7 million, building upon the $24 million from the previous week. XRP maintained momentum, recording its 25th week of positive inflows with an additional $420,000. Butterfill highlighted the continuous support from the “investment community” for XRP, especially in light of the recent “successful legal challenges” against the US Securities and Exchange Commission (SEC). However, it wasn’t all sunshine and roses. Ethereum funds witnessed a setback, with outflows of $7.4 million. This seemed to neutralize most inflows after the launch of six Ethereum futures exchange-traded funds (ETFs) the previous week. Butterfill pointed towards potential “protocol design concerns” as a plausible reason. Other digital assets such as Litecoin, Chainlink, and Tezos also witnessed minor outflows of $280,000, $310,000, and $250,000, respectively. Global Inflow Dynamics Regarding the global distribution of these inflows, Germany stood out, accounting for the bulk of the week’s inflows with $16.1 million. The US and Canada followed suit, with inflows of $2.1 million and $3.5 million respectively. Interestingly, Sweden was the only European nation to witness an outflow of $7.5 million. Butterfill states that despite this positive net inflow trend, “trading volumes remain 27% below the 2023 average.” Regardless, Bitcoin, which led the pack in last week’s inflow, experienced a dramatic shift in recent hours. Specifically, the asset witnessed a swift surge above $30,000, propelled by an unsubstantiated rumor by Cointelegraph about the US Securities and Exchange Commission (SEC) approving a spot BTC ETF. The regulator debunked the rumors. Related Reading: Bitcoin Path To $70,000? Analyst Shows What This ‘Head And Shoulders’ Pattern Reveals However, the crypto quickly retraced its steps once the rumor was debunked, particularly by a FOX Business reporter. 🚨BlackRock has just confirmed to me that this is false. Their application is still under review. https://t.co/XIfIWZ0Ule — Eleanor Terrett (@EleanorTerrett) October 16, 2023 At the time of writing, Bitcoin is trading at $28,049, still exhibiting bullish behavior with a 4.3% increase in the last 24 hours. Featured image from Unsplash, Chart from TradingView