First Ever White House Crypto Summit Kicks Off Today: Could New Crypto Like Best Wallet Token Benefit?

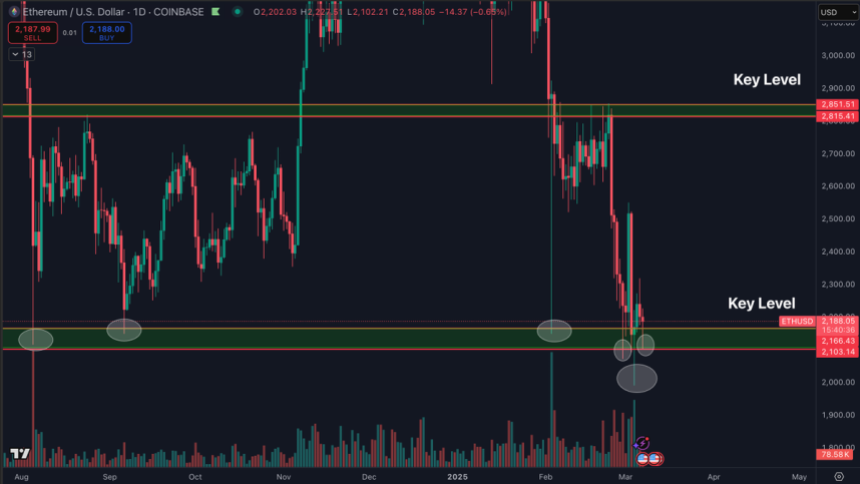

The first-ever White House Crypto Summit takes place today, Friday, March 7. A bevy of industry powerplayers are participating, and while the agenda has yet to be announced, the conversation will undoubtedly include the national crypto reserve, the Digital Asset Stockpile, and other pro-crypto policies. Trump has come a long way in his crypto journey, from crypto skeptic to now pledging to make the US the ‘crypto capital of the world’. The executive order and summit meeting are good first steps in this direction. As sentiment around crypto rises in the US, could new crypto projects like Best Wallet Token ($BEST) cash in? Crypto is the Strategic Order of the Day The executive order establishing the Strategic Bitcoin Reserve and US Digital Asset Stockpile was officially issued on March 6 and sets clear expectations for all US government departments about pooling government-owned Bitcoin. Departments have 30 days to audit and transfer any existing Bitcoin into the reserve. In 60 days, the Secretary of the Treasury will deliver considerations for establishing and managing the reserve and Digital Asset Stockpile. A significant aspect of the order ensures that Bitcoin is held in reserve, demonstrating the value of it as a long-term investment. The order reaffirms sentiment to see crypto and digital assets the same way as traditional assets and harness their power rather than limit it. Delivering on his pledge to ‘Make America the Crypto Capital of the World’, Trump has appointed David Sacks as Crypto Czar, who has already announced on X that no taxpayer dollars will be involved in the reserve. The reserve (estimated to be worth $17B in $BTC) has been seized from criminal activities. Although the reserve refers explicitly to Bitcoin, Trump has shared on Truth Social (a Trump owned social media platform) he would look to include other prominent crypto such as Solana ($SOL) and Ethereum ($ETH). These moves position the US as effectively navigating the new economic waters — many countries haven’t adopted crypto as part of their reserves yet. Arguably, Trump’s actions display the inklings of a well-considered long-term strategy – one that balances the mandate to maintain dollar dominance with the impetus to embrace crypto. Top Crypto Players Take Their Seat at the Table Some of the biggest names from the crypto world are expected to attend today’s summit and discuss ways to open doors for the industry. Expected guests include: Matt Huang: Co-founder of Paradigm Sergey Nazarov: Co-founder of Chainlink Caroline Pham: Acting chairman of the US Commodity Futures Trading Commission JP Richardson: CEO of Exodus David Sacks: AI and Crypto Czar Michael Saylor: Founder of MicroStrategy Arjun Sethi: CEO of Kraken Vlad Tenev: CEO of Robinhood Mark Uyeda: Acting chairman of the US Securities and Exchange Commission Zach Witkoff: Co-founder of Trump-linked World Liberty Financial It’s fair to assume the mood in the summit will be bullish, and with that comes a potential boost for the crypto market. Could Ethereum-based wallet tokens, like Best Wallet Token, capitalize on the increased attention? Best Wallet Token to Benefit From Crypto Summit So many key players from the world of crypto in one room means anything is possible, but it can’t fail to energize crypto markets. Altcoins like Best Wallet Token ($BEST) could ride the wave of exposure and investment. In its presale, $BEST has raised $10.8M since launching in November 2024, and the current token cost is sitting at $0.02425, a 7.78% increase from the initial presale launch price. Dynamic staking rewards of 146% APY are still available to those who stake during the presale. $BEST opens doors, just like today’s Summit should do for participants and the industry as a whole. Holders gain access to exclusive member perks within the Best Wallet ecosystem. These include early access to exciting new crypto projects and reduced transaction fees, higher staking gains, the upcoming Best Wallet debit card, and a Portfolio Management feature. We’ll have to see what today’s crypto summit brings, but the exposure could cause Bitcoin and many of the best altcoins to shift upwards. Check out our guide on how to buy $BEST, and get in now. Crypto is a volatile market; you can experience significant returns, but equally, you may lose your investment entirely. It’s important you do your own research before making any purchases.