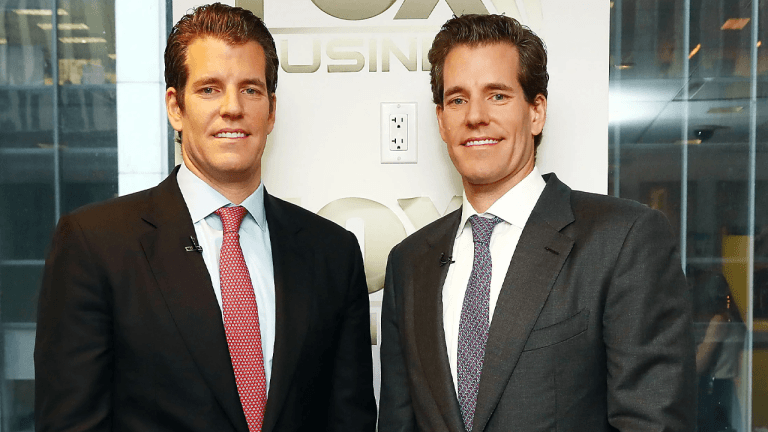

Report: Winklevoss Twins’ Gemini Moves Toward IPO With Confidential Filing

Gemini, the cryptocurrency exchange founded by Tyler and Cameron Winklevoss, has confidentially filed for an initial public offering (IPO) with assistance from Goldman Sachs and Citigroup, Bloomberg reported on March 7, 2025. Major Banks Reportedly Back Gemini’s Bid to Go Public: Confidential Filing Gemini, the cryptocurrency exchange founded by Tyler and Cameron Winklevoss, has confidentially […]