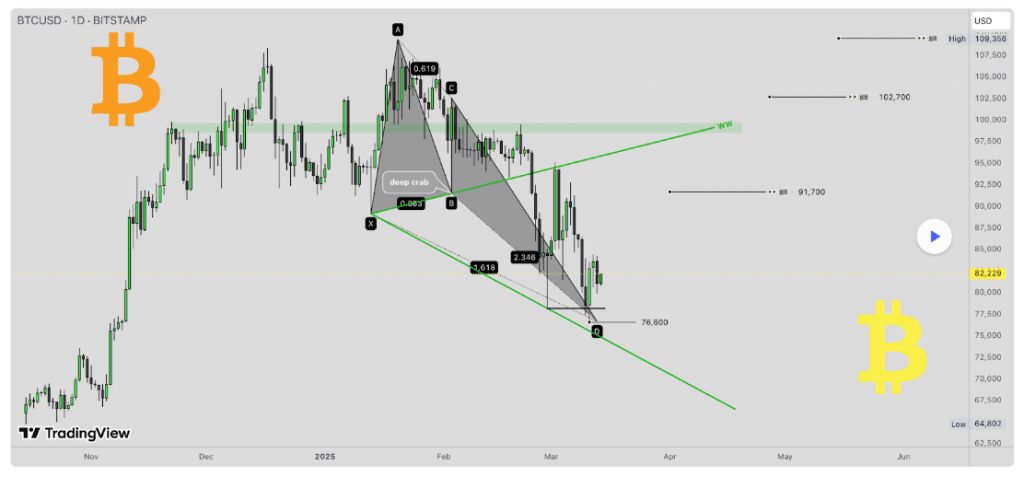

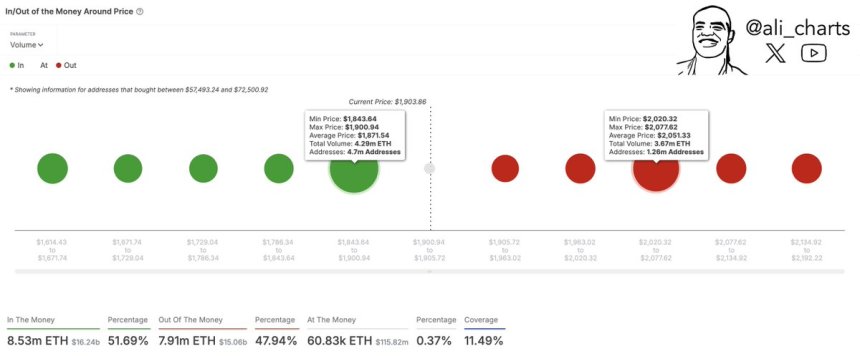

Ethereum (ETH) is now trading below the crucial $2,000 mark, struggling to find momentum after days of selling pressure and consolidation around $1,900. The broader crypto market remains under heavy bearish control, and ETH has lost over 57% of its value, making it increasingly difficult for bulls to stage a recovery. Related Reading: Ethereum Consolidates Since ‘The Big Dump’ – Local Trend Reversal Or Continuation? With Ethereum now below a multi-year support level, this zone could flip into strong resistance, further complicating any potential rebound. The market is in a highly volatile phase, and traders are watching closely for signs of strength or further downside risks. On-chain data highlights two key price levels for Ethereum’s immediate trajectory. $1,870 currently serves as its critical support; meanwhile, $2,050 is now its most challenging resistance, acting as a major barrier that ETH must reclaim to confirm a trend reversal. For now, Ethereum remains vulnerable, with uncertainty driving price action. If bulls fail to defend current support, ETH could see further declines, but a successful reclaim of resistance could spark renewed confidence in the market. The next few days will be crucial in determining ETH’s short-term direction. Ethereum Faces Critical Test As Bulls Struggle To Reclaim $2,000 Ethereum is at a crucial turning point, trading near its lowest level since October 2023 as bears maintain control. After weeks of selling pressure and uncertainty, bulls must reclaim the $2,000 mark as soon as possible to prevent further downside and restore market confidence. Related Reading: Solana Forms Classic Cup-And-Handle Pattern – Analyst Predicts A Breakout To $3,800 The broader macroeconomic landscape remains uncertain, with trade war fears and global financial instability weighing heavily on both crypto and US stock markets. These factors have set the stage for a potential deeper correction, leaving investors on edge. However, some analysts believe a market recovery is still possible in the coming months, particularly if Ethereum can regain key resistance levels. Top analyst Ali Martinez recently shared on-chain metrics, identifying $1,870 as Ethereum’s strongest support level. This means that if ETH breaks below this zone, a further decline could be imminent. On the upside, $2,050 is now Ethereum’s most challenging resistance, acting as a crucial barrier that bulls must overcome. If Ethereum successfully reclaims $2,050, it will signal a strong trend reversal, potentially setting the stage for a powerful recovery rally. The next few trading sessions will be critical, as ETH must either hold its ground or risk further downside, with investors closely monitoring price action. ETH Bulls Must Hold Above $1,900 Ethereum is currently trading at $1,920, following days of consolidation below the crucial $2,000 level. Despite attempts to push higher, bulls have struggled to reclaim lost ground, leaving ETH in a vulnerable position. To confirm a recovery, ETH must break above the $2,000 mark and push beyond the 4-hour 200-moving average (MA) and exponential moving average (EMA) around $2,400. A successful reclaim of these levels would signal renewed buying momentum, potentially setting the stage for a strong rally toward higher resistance zones. However, if Ethereum fails to reclaim these levels, selling pressure could intensify, driving ETH toward lower demand zones around $1,750. A breakdown below this level would put even more pressure on bulls, potentially leading to further downside and extended bearish sentiment. Related Reading: Dogecoin Network Activity Surges 47% In A Month – What’s Next for DOGE? With market conditions still fragile, ETH’s short-term direction remains uncertain. Bulls must step in soon to defend key levels, or Ethereum risks losing further ground, making a quick recovery much more difficult. The next few days will be crucial, as ETH traders watch for a breakout or further downside movement in response to broader market trends. Featured image from DALL-E, chart from TradingView