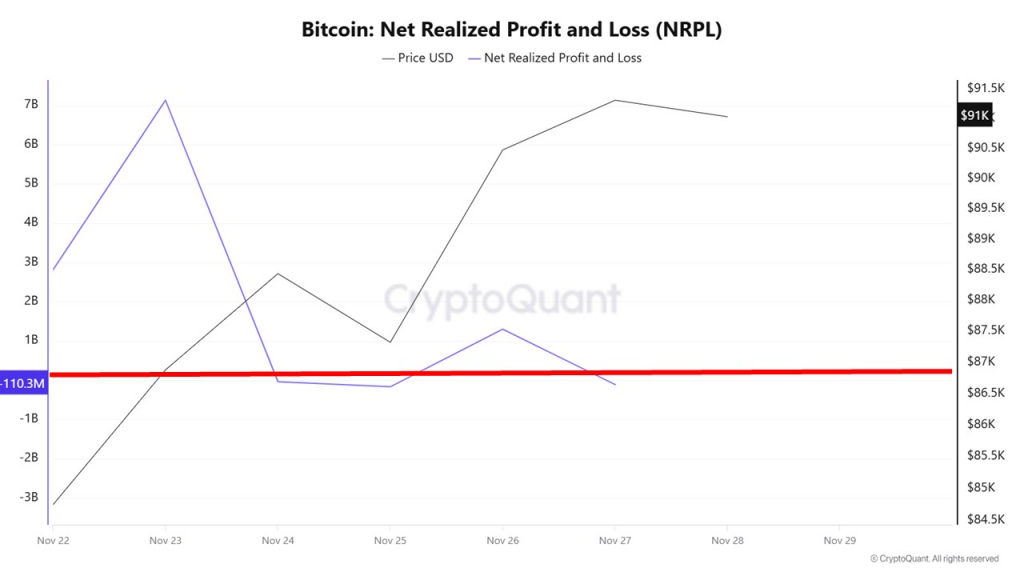

Blockchain analytics platform XWIN Research Japan shares that Bitcoin’s NPRL has returned to a neutral zone following a period of significant volatility. This development represents one of many positives following Bitcoin’s modest price gain over the last week. Related Reading: Newbie Bitcoin Whales Capitulating, But Old Hands Stay Silent NPRL Shows Balanced Market, New Trend Forms On Horizon The Net Realized Profit and Loss (NRPL) is an on-chain metric that measures the total profit or loss that Bitcoin holders realize when they sell their coins at a given price. A positive NRPL suggests more BTC are being sold at a profit rather than at a loss, i.e., market participants are realizing gains, while a negative NRPL means more BTC are being sold at a loss than at a profit. According to analysts at XWIN Research Japan, Bitcoin’s NPRL registered significant positive and negative deviations between November 22 and 24. However, the metric has stabilized in its neutral zone since November 25, as Bitcoin achieved a sustained market recovery. At near-zero NRPL, realized gains and losses are roughly balanced, suggesting market indecision or consolidation. This period usually comes after periods of market capitulation, marking a transition from a volatile phase to a calmer market environment. As earlier stated, the stabilization of NRPL aligns with Bitcoin’s price action, which has recently risen to steady around the $90,000 range. The lack of significant upward or downward pressure suggests that the market is digesting recent volatility and building a foundation for future movements. Analysts at XWIN state similar NRPL neutralization from the past phases has preceded the emergence of new trends, indicating BTC price may be consolidating for a new direction. Related Reading: Bitcoin To Hit $1.5M? Cathie Wood Says It’s Only A Matter Of Time What Next For Bitcoin? Looking ahead, XWIN Research Japan states the critical factor will be whether NRPL maintains its position above the zero line or slips back into negative territory. A sustained positive NRPL would indicate improving demand and healthier inflows, potentially supporting a stronger recovery. Conversely, a return to negative NRPL could signal renewed weakness and the potential for another round of selling pressure. In summary, the recent pattern, from deep negative swings to positive spikes, followed by convergence near zero, demonstrates that the market’s internal structure has largely reset and has completed its clearing phase for a new price trend to emerge. At the time of writing, Bitcoin trades at $90,485 after a minor 0.65% loss in the last 24 hours. Meanwhile, its daily trading volume is up by 14.06% and valued at $57.04 billion. Featured image from Pngtree, chart from Tradingview