Bitcoin Consolidates Below $120K as Exchange Activity Reflects Mixed Market Signals

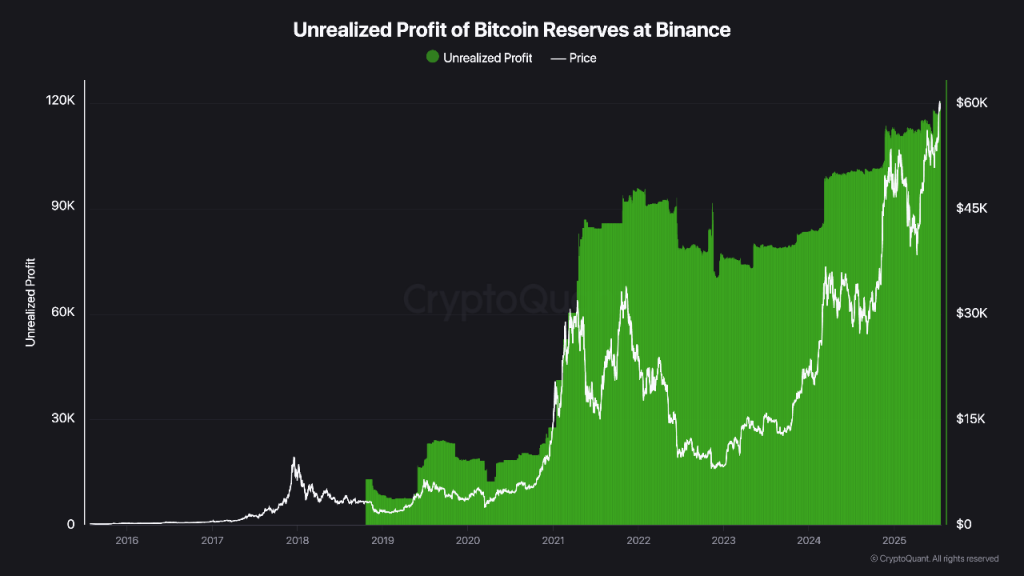

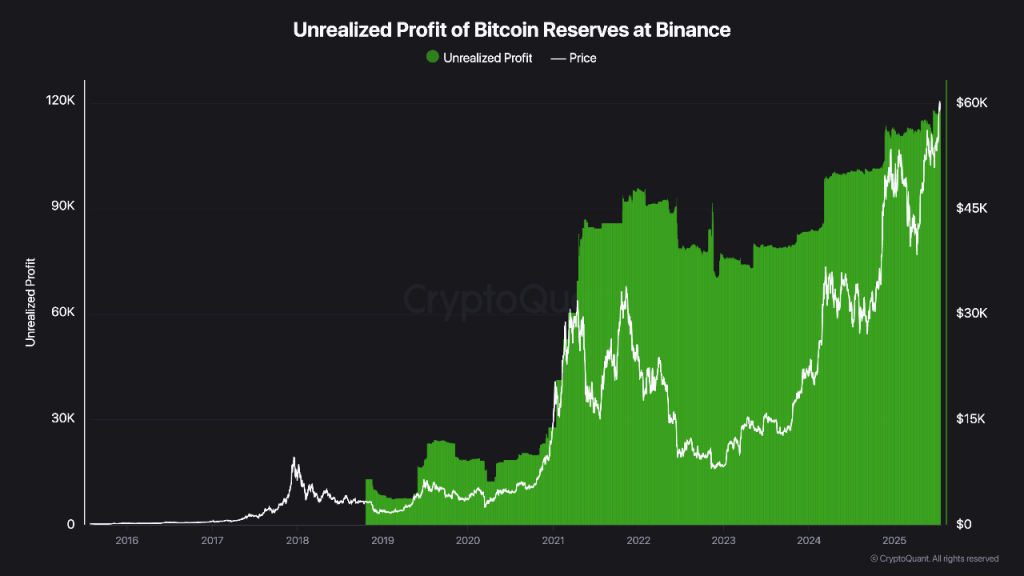

Bitcoin continues to hover below its all-time high, with current trading levels near $118,000 reflecting a 0.6% daily drop and a 3.8% pullback from the peak above $123,000 recorded earlier this month. While the broader trend remains uncertain, analysts have assessed on-chain activity for signs of the next major move. Recent data from CryptoQuant analysts highlights a divide between retail and institutional behavior across leading exchanges, raising questions about potential profit-taking or strategic accumulation. Related Reading: Bitcoin Must Defend This Key Support For $180,000 Year-End Target, Analyst Says Bitcoin Retail Traders Sell into Strength, While Whales Accumulate On the one hand, short-term holder (STH) behavior on Binance suggests some market participants are opting to take profits following the asset’s strong rally. On the other hand, Kraken has recorded a sharp outflow of Bitcoin, a movement typically associated with whale activity or long-term accumulation. This contrasting activity across platforms suggests a split in market sentiment, with retail traders potentially trimming their exposure and larger players preparing for sustained upside. According to CryptoQuant analyst Amr Taha, the Binance Exchange Inflow Ratio for Short-Term Holders recently crossed the 0.4 level, historically linked to increased retail selling pressure. These STHs, who typically hold Bitcoin for fewer than 155 days, tend to deposit funds to exchanges during periods of price strength to lock in gains. The spike above this threshold may indicate a growing tendency among retail investors to exit positions in anticipation of volatility. In contrast, the same analysis pointed to significant outflows from Kraken, with over 9,600 BTC withdrawn on July 22, one of the highest single-day outflows seen in recent months. Taha interpreted this as a potential signal of whale accumulation, with institutional or high-net-worth participants removing assets from exchange custody, often in preparation for long-term storage. This divergence in behavior between Binance and Kraken highlights the differing strategies employed by market segments, with retail users leaning toward short-term positioning and whales opting for long-term accumulation. Binance Reserve Trends Highlight Strengthening Profit Margins Adding another layer to the evolving market picture, CryptoQuant analyst Darkfost shared that Binance’s unrealized profit on its Bitcoin reserves has hit an all-time high of approximately 60,000 BTC. This figure has grown despite a gradual decline in total BTC reserves held on the platform, which have fallen from 631,000 BTC in September 2024 to 574,000 BTC as of now. A portion of these holdings, around 16,000 BTC, is locked in custodial wallets to back the BTCB token on the BNB Chain, serving operational purposes. Darkfost emphasized that decreasing exchange reserves are often interpreted as a sign of investor confidence, reflecting a preference to store Bitcoin in personal wallets rather than leaving it on centralized platforms. Related Reading: Trump Media’s $2 Billion Bitcoin Buy Sparks Surge In Stock Price The rise in unrealized profit amid falling reserves may indicate that while outflows persist, the remaining holdings have appreciated significantly in value, highlighting the platform’s strengthened position. Featured image created with DALL-E, Chart from TradingView