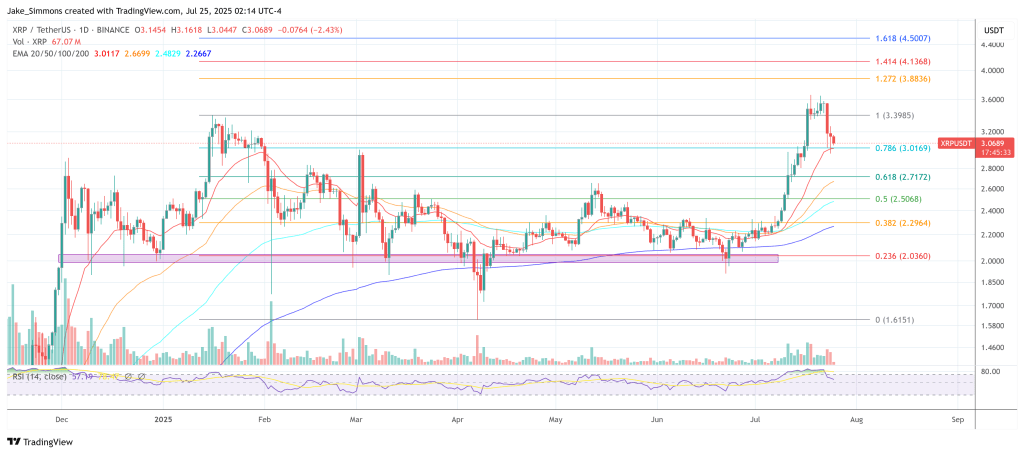

In an interview hosted by Kyle Chassé, Bitwise Chief Investment Officer Matt Hougan and Bloomberg ETF analyst James Seyffart weighed in which spot ETF could attract more inflows– XRP or Solana–if approved on the same day. Both concluded that the initial wave of capital would likely favor XRP, even as longer‑term asset accumulation could tilt toward Solana. XRP or Solana: Which Spot ETF Will Dominate? Seyffart grounded his view in the performance of existing derivative‑based products. “We did have, we had a kind of a situation like this where we had futures Solana ETFs and leverage futures or derivatives based ETFs that have exposure to Solana launched before the XRP versions. And the XRP versions have got more assets and flows than the Solana version,” he said. While cautioning that “derivatives based products are nowhere near as high in the list of demand for investors as the spot products would be,” he cited that precedent alongside the strength of XRP’s retail community. According to Seyffart, a “pseudo spot product from Rex Osprey that went through a whole bunch of loopholes and end arounds to try and get exposure to spot Solana with staking” has also “done very well,” but not enough to alter his near‑term ranking. Related Reading: Analyst Reveals The Real Reason XRP Price Crashed Yesterday “I think in the near term, I would bet on XRP, but over the long term, I’d probably bet on Sol getting more assets,” Seyffart continued, pointing to mass‑market familiarity with XRP narratives—“anyone I know who doesn’t really know this space at all…they like XRP. They think it’s gonna be the backend settlement system for all banks”—and the persistent volume of XRP‑related discussion across TikTok, Reddit and other social platforms. “The ground game is unreal,” he said, before adding that institutional conversations skew differently: “From an institutional point of view…there seems to be a lot more serious people looking at Solana…definitely I lean Solana or Ethereum from my point of view.” Hougan concurred with the sequencing. “I actually agree. I think XRP would do better out of the gate,” he said, emphasizing that the intensity of a committed minority, rather than broad sentiment, drives day‑one ETF flows. “I think the average opinion of Solana is better than it is for XRP across crypto investors, but that’s not who buys the ETF on day one. It’s the passion, right?” Related Reading: XRP Whales Move $759M In Token: What Are They Up To? Recounting his experience at an XRP‑focused event, he underscored the depth of that base: “I went to an XRP conference in Vegas on a Saturday. There were 1,200 people in the room. Every seat was taken. That’s crazy…There is an army of people who are really passionate about XRP, and I think it would do exceptionally well out of the gate. It doesn’t matter, again, that 90% of people hate it. What matters is 10% of people love it.” Hougan added that Solana’s eventual trajectory would depend on its “narrative transition,” suggesting a shifting storyline around the network could influence timing-sensitive allocations. “If Solana is ripping…it would do well,” he said. “But my base case out of the gate would be XRP, at least for the first few months.” Taken together, the analysts’ assessments outline a bifurcated path: an early surge in XRP spot ETF inflows propelled by a highly mobilized retail constituency, followed by a potential reversion in which Solana, benefiting from deeper institutional engagement and evolving narratives, could surpass XRP in total assets over time. At press time, XRP traded at $3.06. Featured image created with DALL.E, chart from TradingView.com