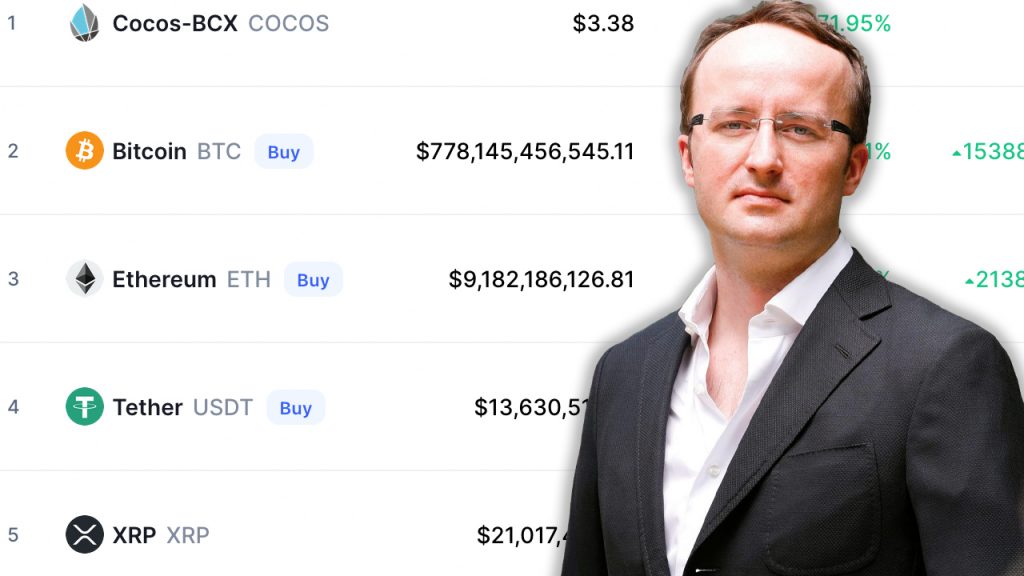

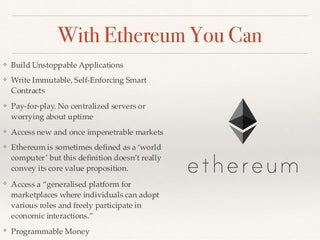

Advice on buying $100k in ETH

Basically, I have $100k I want to invest into ETH within the next 4 months and want to hold for it for at least 6+ months. How would you recommend I go about this? To move that much money without problems and keep it safe. Background: I'm pretty new to crypto, and I've been…

Read more