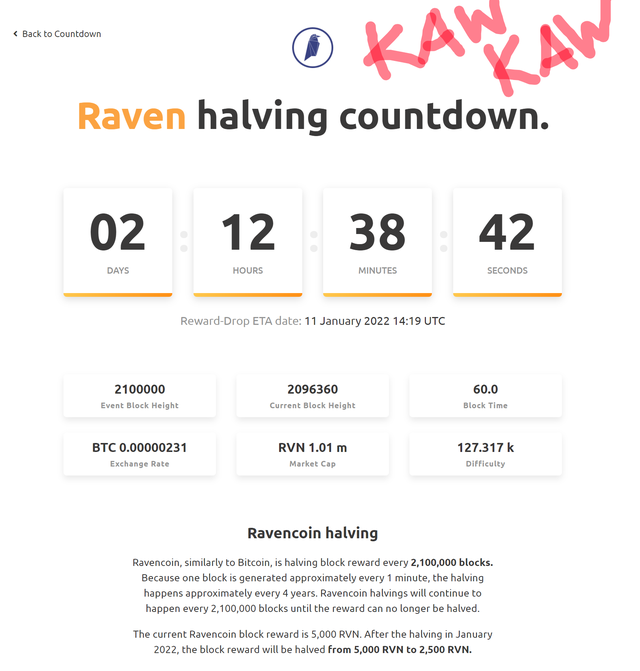

Hi guys. I have a huge question for you.

Isn't it strange that for the last two years we have been receiving a lot of free money from the government, and this is causing huge inflation. And I heard that people invested this money in cryptocurrency. And right now I see this huge failure… And one question stuck in my head…Maybe this whole crypto…

Read more