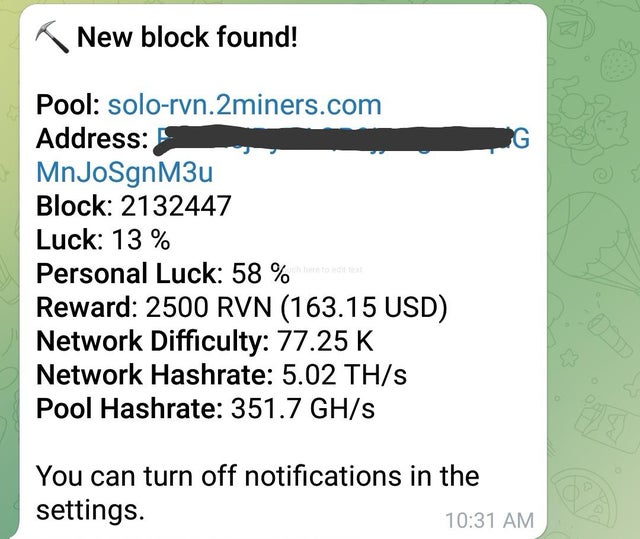

I teached my son (12) all about crypto yesterday!

My son was always asking me about crypto and what I do with it. I got all excited and decided to open a wallet up for him and let him set it up and invest all his saved up pocket money. We both sat down and I explained him about the market, which coins to…

Read more