Crypto prices may fall at a rate the world has never seen before

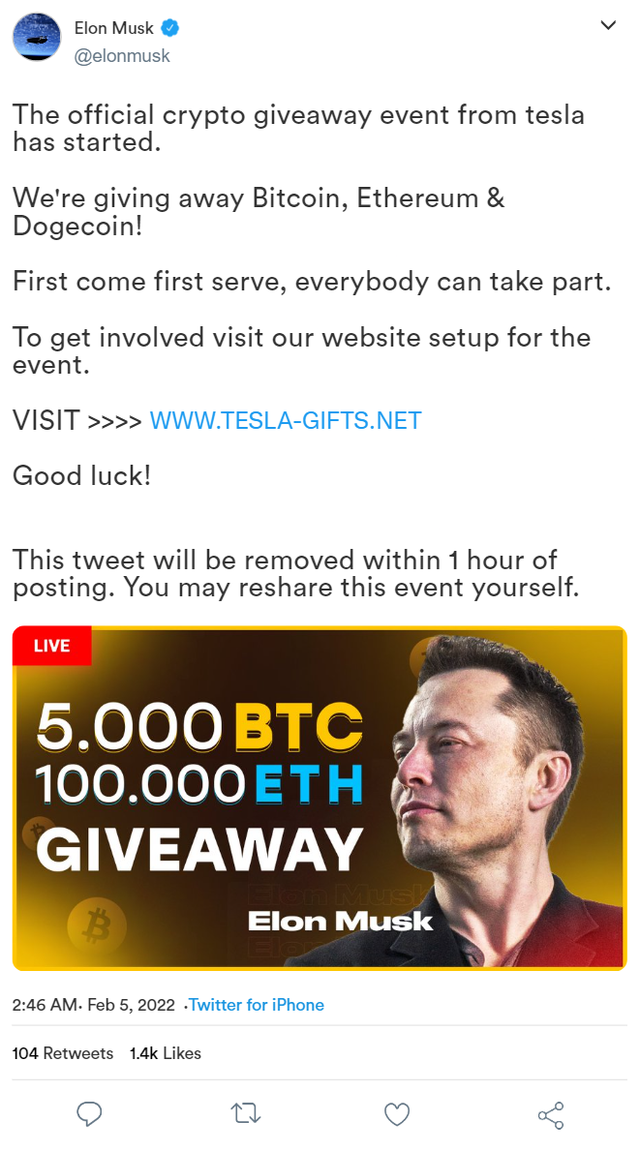

Here are some valid reasons why this may happen Because literally anything can happen, dummy. This is just a simple reminder that just because a post makes you feel good, doesn't make it true. And just because you don't agree with a post, doesn't make it wrong. Prices fell for a couple months and this…

Read more