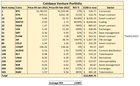

I analyse the 18 coins in Coinbase Venture portfolio from Jan 2021 to today date. $100 invested in each of these 18 coins is worth $22,831 now. Also: NASDAQ is +11% and Gold is -7%.

We all know Coinbase but not all of us had heard of Coinbase Venture. It is an investment arm of Coinbase to invest in early-stage cryptocurrency and blockchain startups. You can check the portfolio at Messari website. Their portfolio contains 18 coins as of now: Bitcoin (BTC) and Ethereum (ETH) Larger market cap ($5B plus):…

Read more