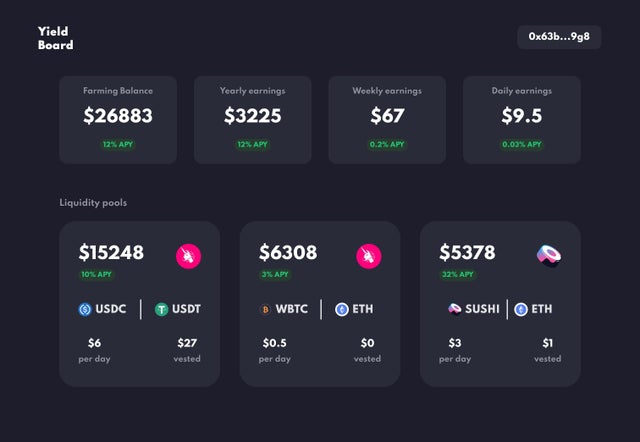

Rebuilding capitalism SocialGood is a blockchain initiative that aims to reshape capitalism as we know it by working to create a donation machine that combines blockchain with artificial intelligence in an app. The app can be downloaded on Google Play for Android and Apple Store for iPhones, and by using it, users could receive up to 100% of their purchase back in crypto. This will be reflected within a few days after SocialGood has received confirmation of your purchase from any of its affiliated shops and partners. One thing to keep in mind is that there is a maximum amount per purchase – $10,000 – but you can make as many purchases as you like. Through everyday shopping, users as consumers can build up their assets at no cost to them. The more the company’s sales increase, the more the number of users increases and the core value of the assets tends to rise. As a result, when consumers shop from their retail partners through the network, they are given a portion of their purchase price in SG digital assets for free. How does the SocialGood App work? According to SocialGood’s Zendesk, a user is able to, through the use of the app when shopping, receive crypto assets (called SocialGood, or for short SG) for free. This service is the only one of its kind globally, and the project already has been granted patents for it. The longer you hold onto SG, the amount you could potentially receive increases, so go ahead and HODL onto your SG for a long time! When SocialGood’s value goes up, users can transfer SG from their app to their account on a linked cryptocurrency wallet and make a profit by selling it on the market. SocialGood is designed in a way in which the more people hold it, the higher its price will be, this leveraging of buying pressure benefits all. After SocialGodd was listed on the US-based cryptocurrency exchange, Bitmart, at the end of July 2020, prices increased 7,529% within 15 days. Further benefits The SocialGood App is user-friendly and super easy for anyone to use, it introduces the cryptoverse to the average person who may not be familiar with crypto assets, cryptocurrencies and the like, in a very straightforward manner. In the Social Good Ecosystem™, the more users purchase products, the more they increase their assets, and at the same time automatically contribute to society. Since the launch of their service in March 2019, over 1.6 million users have joined the app. Companies such as Alibaba, eBay, Lazada, Nike, and Booking.com are in this ecosystem and in total partnerships have been secured with over 1,860 major companies internationally as of the end of May 2020. SocialGood has provided cryptoback to all users who have made purchases on the app when they’ve met the cryptoback terms and conditions. By putting partner companies on the App, the operating company is able to receive advertising revenue from their business. As the partner companies are happy to have a new way of increasing their customer base, users are able to partner with more companies daily.