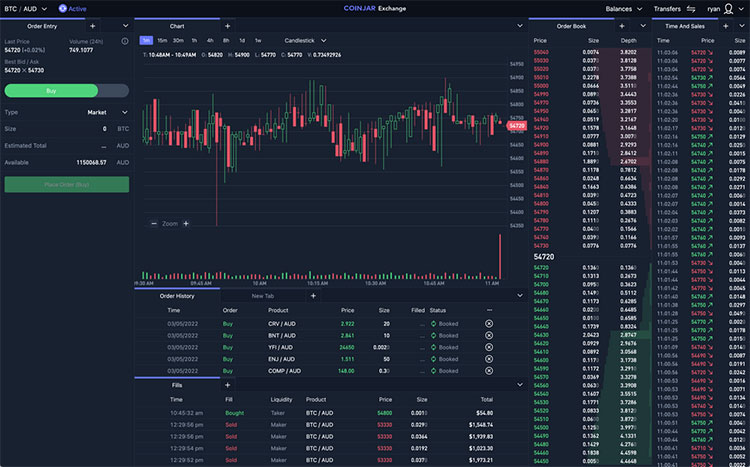

On the 6th of May, Polkadot’s most recent auction round came to an end, generating over $13.8 million and bringing a new platform to the system. The winner of this auction, Polkadex, put up 973,324 DOTs across over 6000 community member donations, demonstrating the incredible community push that was behind this win. Polkadot is an interoperable blockchain ecosystem that offers high levels of security, user-driven governance, high energy efficiency, and is readily built for rapid scalability. Part of this scalability comes through its interoperable parachains, with many different blockchain systems linking into the central chain. By winning the most recent parachain slot auction, Polkadex has become the 16th chain to become embedded into Polkadot. Polkadex is built on substrate, providing a user-friendly decentralized order-book exchange where users can participate in high-frequency trading and other DeFi functions. The COO of Polkadex, Deepansh Singh, comments on their parachain win, suggesting that “Thanks to the Polkadex parachain, we will be able to bridge assets with the Dotsama ecosystem and now users will be able to trade Polkadot ecosystem tokens from across the whole spectrum of parachians,” signaling the core interoperability that Polkadot offers. Equally, he continued by marking this as a monumental event for the ecosystem itself, “This is a first for Polkadot and a first for DeFi as a whole,” seeing the potential for the expansion of both Polkadot and Polkadex with their parachain win. As Polkadex can now interact with all of the other blockchain assets within this ecosystem, the versatility of application of their platform has been radically increased. Campaign Strategy This round of crowdloan saw Polkadex become the very first parachain auction to surpass it’s 90% target cap of $1 million USD, making this the largest in Batch 3. Part of what made this campaign so effective was Polkadex’s rallying within their own community, providing many benefits to users that decided to get involved with the funding opportunity. Polkadex created an auction cap of 1 million DOT tokens, but offered 2 million PDEX tokens (which is 10% of the total supply). Due to the ratio they created, there was a 2:1 opportunity, with users being able to get at least 2 PDEX tokens for every single DOT token that they added to the campaign effort. Considering the vast utility of PDEX, allowing users to get discounts on any Polkadex transitions made, lowering trading fees, providing governance voting, and even offering staking opportunities, it’s no wonder that the community flocked to this fantastic crowdloan structure. Alongside token allocation, Polkadex offered the top 1,000 crowdloan participants the opportunity to get a utility-based NFT, which provides even further discounted fees on all of their Polkadex orderbook transactions once it has launched. These rewards were also distributed through several DeFi platforms that Polkadex partnered with during the event. Large-scale exchanges like Kraken and KuCoin were all involved, being equally balanced by decentralized platforms like Equilibrium and Parallel Finance, allowing the community to get involved through whichever financial system they prefer. Commenting on the fantastic community effort, the head of marketing at Polkadex, Dagmara Handzlik, stated that they are “extremely proud of the way the Polkadex community led the charge during the crowdloan campaign.” Following this, she stated that, “Polkadex is proof of how important a strong community is to the overall success of a project, and we could not be more excited to deliver the products we have been building with the eager support of Polkadexers.” By winning this campaign and obtaining a parachain slot, Polkadex is one step closer to becoming the central trading engine for Web3 and DeFi as a whole, with the Polkadot ecosystem now set to benefit from this comprehensive, cutting-edge crypto trading solution.