Why Terra’s Anchor Protocol Changed Earn Rate To 18% APY

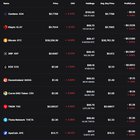

Anchor Protocol, one of the most popular platforms in the Terra ecosystem, rolled out a change in its Earn Rate. The latter will begin to operate in a semi-dynamic fashion rather than the previously fixed 20% annual percentage yield (APY). Related Reading | Terra Price Continues Moving North; How Soon Will It Cross $100? With a massive shift in the protocol’s reward mechanism, the new models aim at making Anchor “more sustainable”. As a result, users started earning an 18% APY as of yesterday, May 1. The earn rate will be modified each month for the foreseeable future. The team behind this Terra project said the following via their official Twitter account: The Anchor Earn rate adjusts dynamically by up to 1.5% each month based on if the yield reserve appreciated or depreciated. The floor is 15% APY & the ceiling is 20% APY. The changes in Anchor’s earn rate are triggered by the protocol’s yield reserve. A .25% modification in this element will be followed by an adjustment in the Earn Rate. This shift in the Terra protocol was approved, via Proposition 20, on March 24 this year. At the time, Anchor Protocol said: The addition of a semi-dynamic Earn rate will contribute to the long-term sustainability of Anchor & will benefit users of the protocol by enabling yield reserve growth while continuing to provide an attractive yield on UST. As seen below, the total borrowed versus total deposits on Anchor shows significant divergence. This is why the yield reserves on the protocol trend to the downside, especially in times of bearish price action on larger cryptocurrencies. Some of the users believe that this trend could trigger a deppeging event for UST which could jeopardize the entire Terra ecosystem. The introduction of a semi-dynamic rate is the first step to avoiding this possibility. Terra Is Not The Most Attractive Venue For Stablecoin Yield? Some users believe that the new earn rate might not be enough and have been suggesting the implementation of investment strategies that can contribute to the yield reserves. Another part of the community seems focused on increasing the borrowing rate at Anchor. However, as the chart above shows, deposits on the Terra protocol have been trending to the upside at a fast pace. In the meantime, the number of borrows has been moving sideways with a slight uptick in recent months. Over the same period, other network launched their own stablecoins with alternatives to Anchor. NEAR and TRON stand out because of the hype and the APY that they are offering to their users. TRON seems to have the largest incentives as it provides depositors with a 30% APY. Like Terra users with Anchor, many wonder if those rewards will be sustainable. Related Reading | Terra Users Heads Up, Why NEAR May Launch Native Stablecoin With A 20% APR At the time of writing, Terra (LUNA) trades at $83 with a 6% profit in 24-hours.