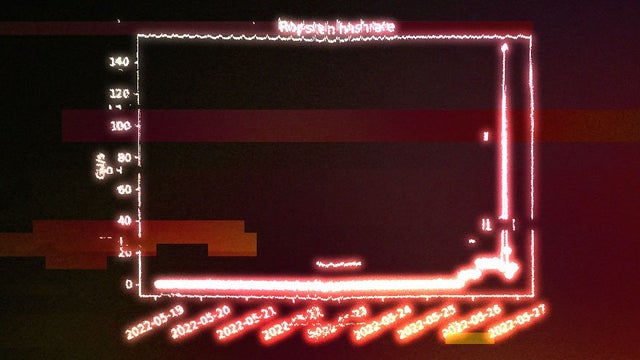

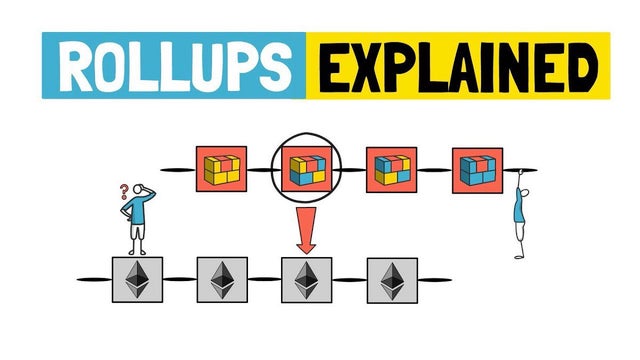

It’s easy to lose track of why you started in these tough times and tough market conditions. I’d like to remind everyone that Ethereum and scaling solutions continue to grow and build.

I understand, pretty much most of your portfolio is down by a landslide and things are starting to look bleak. You don't know how long it's going to take until you properly see green again or start making any form of profit. It's easy to forget your entire journey and hyper focus on the loss…

Read more