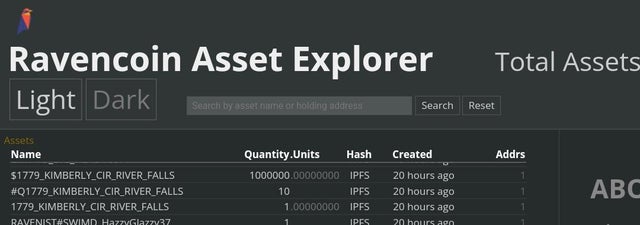

Is FTX saving the crypto industry or taking control of it? The derivatives-focused cryptocurrency exchange has been on the sidelines, watching everything around them collapse, and finally decided to take action. That or, as the rumor says, FTX created this whole situation in their labs and is now buying assets on the cheap. There’s only circumstantial evidence of that, though. The bailout, on the other hand, is completely real. The proceeds of the credit facility are intended to be contractually subordinate to all client balances across all account types (BIA, BPY & loan collateral) and will be used as needed. — Zac Prince (@BlockFiZac) June 21, 2022 Earlier, BlockFi CEO Zac Prince tweeted, “today BlockFi signed a term sheet with FTX to secure a $250M revolving credit facility providing us with access to capital that further bolsters our balance sheet and platform strength.” For his part, FTX CEO Sam Bankman-Fried replied “today we’re injecting $250m into BlockFi and partnering with them so they can navigate the market from a position of strength.” Sources tell me that it is common knowledge within the #Crypto industry right now that Alameda (FTX) & SBF are 100% trying to push the #Bitcoin price down right now to liquidate a number of market participants including, but not limited to #Celsius. pic.twitter.com/u4o8s60m2S — N (@NickNew41532832) June 21, 2022 Over the last few weeks, the crypto market has been trending down. The contagion effect of the Terra/ Luna extinction event rocked every company out there, most of all those who offered yield on cryptocurrency deposits like BlockFi and Celsius and hedge funds like Three Arrows Capital. These companies’ problems and possible liquidation of assets, in turn, sent the crypto market into even more turmoil. Related Reading | Crypto Exchange FTX US Sees Growth: Trading Volume Surged 512% In Q3 What Is FTX ‘s Endgame? We wouldn’t know, but the exchange put itself in a position of power with all of these movements. According to Bankman-Fried, BlockFi “successfully removed at-risk counterparties preemptively,” and the company acted decisively by “removing troublesome counterparties before they become a problem, and adding cash before it was necessary.” And yes, by “troublesome counterparties” he means Celsius and 3AC. 3) Sometimes leadership means acting decisively and that’s what BlockFi did: removing troublesome counterparties _before_ they become a problem, and adding cash _before_ it was necessary. — SBF (@SBF_FTX) June 21, 2022 For his part, Zac Prince frames it as a victory all around. “Throughout the market volatility of the last several weeks, I’m incredibly proud of how our team, platform and risk management protocols have performed. Today’s landmark announcement reinforces BlockFi’s commitment to serving its clients and ensuring their funds are safeguarded”. However, are $250M enough for a company this size? Let’s hope it is, for the sake of its clients. In any case, both companies seem excited to collaborate. Prince said, “this agreement also unlocks future collaboration and innovation between BlockFi & FTX as we work to accelerate prosperity worldwide through crypto financial services.” On the same subject, Bankman-Fried claims FTX is “excited to partner with BlockFi to offer industry leading products.” So, everything’s peachy on the crypto front at the moment, right? However, what happens if BlockFi keeps losing money? Does FTX get a chance to buy the whole company for peanuts? SOL price chart on FTX | Source: SOL/USD on TradingView.com BlockFi ‘s Previous Problems In an article about the subject at hand, Zerohedge reminds us of a recent episode in BlockFi’s history: “As a reminder, BlockFi was fined $100 million in February this year for its high-yield interest accounts, which were deemed as security products by the United States Securities and Exchange Commission.” And, who could forget when they gave out BTC instead of stablecoins to some lucky users? “One Reddit-user shared a screengrab of their bonus payment showing that they received 701.4 Bitcoin, which equates to more than $24 million US dollars at the time of writing. They said they believe they were owed around $700 USD and that the Bitcoin transaction had been reversed.” Related Reading | BlockFi Co-Founder Sees Huge Growth And FOMO For Crypto In 2022 To that, Zac Prince responded, “Our team is battle tested and has weathered many storms over the years, which only makes us stronger and more resilient as we navigate today’s market environment.” That’s a way of putting it. However, what could he say about the rumor that the company lost more than $285M during the bull market? @BlockFi income statement is real bad It's a mess of negative numbers, let's dig into it togetherhttps://t.co/Kr9lhiH8AS — otteroooo (@otteroooo) June 19, 2022 If the rumors are true, does that guarantee that their business model failed and they won’t be able to survive the bear market? No, it doesn’t. It suggests it, though. Featured Image by Cytonn Photography on Unsplash | Charts by TradingView