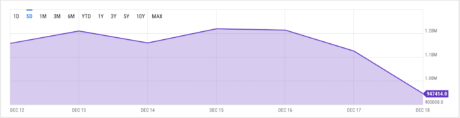

BNB Price has been seeing a lot of declines since Binance came under fire for the audit published by Mazars. Fear, Uncertainty and Doubt (FUD) had spread like wildfire, leading to more than $5 billion in withdrawals from the crypto exchange. Nevertheless, Binance was able to withstand the onslaught and amid all of this, activity on the Binance Smart Chain has fallen drastically, painting a bearish picture for the BNB price. Binance Chain Activity Drops By 15% Last week, there had been a lot of activity on the Binance Smart Chain which saw daily active addresses climb as high as 1.2 million at the start of the weekend. However, as the new week is ushered in, this metric has taken a swift beating and the number of daily active addresses has declined dramatically. Related Reading: Polygon Profitability Tanks As MATIC Nosedives 5.6% Data from YCharts show that in the last 24 hours, Binance Smart Chain active addresses were down by more than 15.70%. This showed a complete reversal in the high usage recorded between Friday and Saturday when activity on the chain had surpassed all other blockchains. Currently, the number sits at 947,414 daily active addresses on the blockchain. So from Friday to now, active addresses are down by more than 150,000. BSC daily active addresses falls 15% | Source: YCharts New unique addresses per day were also down during this time and are down by 15.27% in the 24-hour period. Likewise, transactions per day also took a beating, falling 15.27% during this time while transaction fees realized on the network declined by 10.86%. Interestingly, the daily active BEP-20 addresses on the Binance Smart Chain saw the most upside for the time period with a 9.84% growth, as well as the BSC average transaction fee seeing a 6.58% rise to $0.1457 per transaction. How Will BNB Price Respond? At the start of the weekend when activity on the Binance Smart Chain had begun to surge, there was a notable increase in the BNB price during this time. The digital asset had clocked a local peak of $264 on Friday before active addresses had begun to lose momentum. BNB price trending below $250 | Source: BNBUSD on TradingView.com By Saturday, the more than 100,000 declines in daily active addresses were followed by a sharp drop in the price of BNB. This drop to the $220 territory showed a correlation between the activity on the blockchain and the price of the coin. Related Reading: Double-Digit Losses Brings Doge Below Critical Level, More Pain To Follow? If the cryptocurrency were to keep up with this trend, then BNB’s price could see a possible decline today. However, just like the weekend, such a decline would only be temporary and a sharp recovery will expectedly follow not much later. Another 10% drop from current prices will see the digital asset revisit the $220 territory once more. BNB is changing hands at a price of $246 at the time of this writing. It’s down 0.49% in the last day and 12.37% in the last week, according to data from Coinmarketcap. Featured image from Binance, chart from TradingView.com