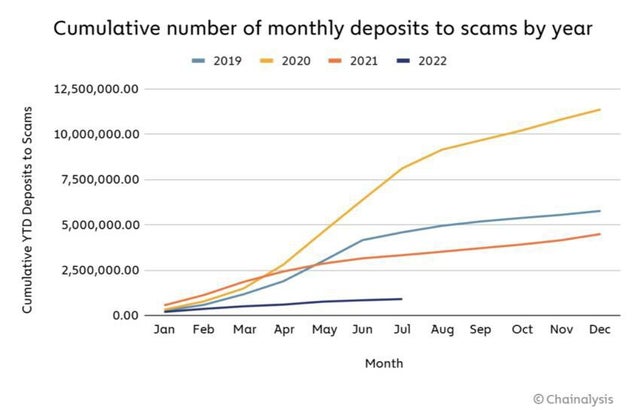

Don’t fall for fake-outs in either direction over the coming weeks.

As the title says, we have < 3 weeks of 2022 and the holiday season is about to be here with businesses being closed or many peoples taking vacation around this time. Market volume tends to get lower and more volatile at this time so don’t go all in right now. January is usually a…

Read more