UPDATE: A Week After Getting Hacked for 300k – Cashing Out at a KYC Exchange

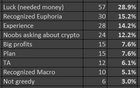

Note to Mods: This is an update to this post: https://www.reddit.com/r/CryptoCurrency/comments/11sksgs/i_got_hacked_and_lost_over_300k_today/. Please let me know if this is ok to proceed. It's been a week since I lost access to 3 of my wallets totaling over 300k. Unfortunately, I was a victim of a cyber attack by a hacker who managed to drain away almost…

Read more