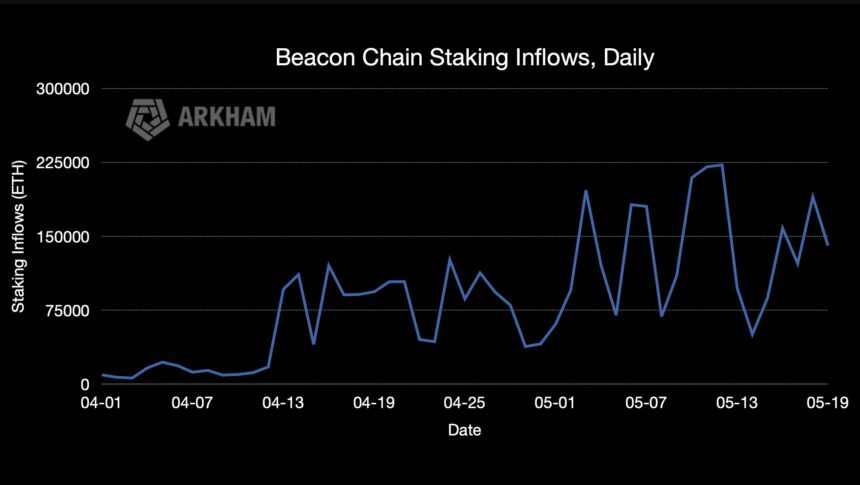

Ethereum’s (ETH) Beacon Chain has seen significant inflows since staking withdrawals were enabled on April 12th, with over $7.7 billion worth of Ethereum deposited into the contract. This is despite some initial predictions of a flood of outflows following the Shanghai Upgrade. The Beacon Chain is a core component of Ethereum 2.0, the next generation of the Ethereum blockchain. It is a Proof-of-Stake (PoS) blockchain responsible for coordinating validators, validating transactions, and proposing and finalizing blocks in the Ethereum network. Related Reading: Dogecoin Transaction Count Rises 60X, But Why Are Prices Down? Ethereum Beacon Chain Defies Critics According to the research firm Arkham Intel, The total amount of deposited Ether now exceeds the April 12th balance by around 1.25 million ETH, with daily deposits varying widely, sometimes reaching up to 225,000 ETH (over $400 million in a single day). The inflows chart shows a noticeable spike following the Shapella upgrade, which coincided with the full enablement of withdrawals from the Beacon Chain. At the forefront of these deposits is Lido’s stETH address “0xae7”, which has consistently been the top depositor with a lifetime deposit amount of well over $15 billion, accounting for over a third of the ETH locked in the deposit contract, according to Arkham. Following the enabling of stETH Unstaking, Lido’s deposit address has now been transferred to a new address, “0xfdd”, which has already become the 4th deposit address since April, with a total deposit amount of over 214,000 ETH, or over $386 million, despite only being active for the past three days. Furthermore, the growth of Ethereum 2.0 and the Beacon Chain has been accompanied by a surge in staking services and Liquid Staking Tokens with Frax. This stablecoin project aims to provide a more stable and reliable alternative to traditional fiat currencies, being one of the notable players in this space. Frax offers a product called frxETH, which allows users to stake their ETH and receive liquid-staked ETH tokens (sfrxETH) in return. Although Frax ranks 14th on the leaderboard of depositors, their total stake of 72,400 ETH since April 1st represents a significant portion of their total Frax ETH supply, accounting for 33.6% of the total frxETH supply of 215,000. The growth of staking services and liquid staking tokens is a positive development for the Ethereum ecosystem, as it provides users with more options for earning rewards on their ETH holdings. This growth is also a testament to the popularity of Ethereum 2.0 and the Beacon Chain, which offer a more efficient and sustainable network for decentralized applications. ETH’s Price Action Suggests A Bearish Future According to Michael Van de Poppe, a well-known cryptocurrency analyst, ETH’s price resembles more of a bear flag than a consolidation pattern. He believes that the Relative Strength Index (RSI) is higher on ETH, and when combined with the chart pattern, it is likely that ETH will experience another leg down, making it more probable than Bitcoin (BTC). Van de Poppe points out that for him to change his mind about ETH, the resistance level that needs to be broken is $1,867. However, if the candle closes below $1,735, there is a high likelihood of continuation toward the range of $1,675 to $1,712, with the lower $1600 as the next potential support level. Related Reading: How Does Current Bitcoin Rally Compare With Historical Ones? Despite the current short-term uncertainty in the cryptocurrency market, the long-term outlook for Ethereum and the broader digital asset industry remains positive. However, while it can be challenging to predict short-term price movements, Michael Van de Poppe’s analysis suggests that the short-term outlook for Ethereum may be bearish. Featured image from Unsplash, chart from TradingView.com