Shiba Inu (SHIB) Price Slump Leaves Over 1 Million Wallets In The Red Zone

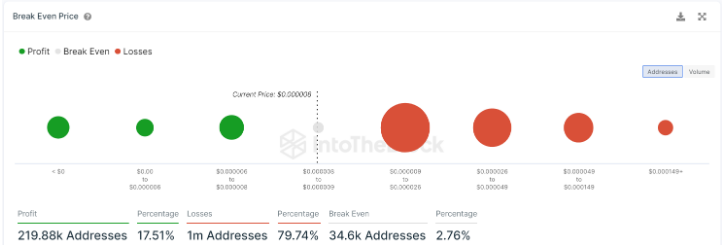

Shiba Inu (SHIB) has experienced a significant price drop, causing a considerable number of investors to find themselves in a precarious position. With the recent downward trend in SHIB’s value, a staggering 1 million addresses now find themselves in the red zone, facing losses in their investment. In the context of crypto trading, the term “red zone” often refers to a situation where a digital currency is experiencing a significant decline or negative price movement. It is commonly associated with bearish market conditions or a downtrend. Related Reading: Shiba Inu All Green Today – What’s The Energy Behind The Glow? This turn of events has sparked concern and curiosity among cryptocurrency enthusiasts and market observers alike, as they analyze the factors behind the price decline and its implications for the future of Shiba Inu and its large investor base. Break Even Indicator Highlights Shiba Inu Price Drop Impact In the midst of a volatile cryptocurrency market, the price of Shiba Inu (SHIB) on CoinGecko currently sits at a meager $0.00000852. Recent data indicates that SHIB experienced a modest 0.4% rally within the past 24 hours, but endured a gradual 2.0% decline over the span of seven days. Source: Coingecko According to IntoTheBlock the Break Even Price indicator, the price movement has left a significant impact on SHIB investors. Out of the total SHIB addresses analyzed, approximately 1 million addresses, accounting for 79.74%, find themselves in losses. Source: IntoTheBlock On the other hand, 219,880 addresses (17.51%) have either realized gains or are currently in profit. Additionally, 34,600 addresses (2.76%) are at a break-even point, meaning they are neither in losses nor profits. Related Reading: Should BONE Holders Worry About Shibarium’s Delayed L2 Launch? The Break Even Price indicator is a metric that examines the realized gains and losses of SHIB holders based on on-chain data. It provides a comprehensive overview of the collective gains and losses experienced by those holding the Shiba Inu cryptocurrency. This data sheds light on the overall financial state of SHIB investors, highlighting the prevailing challenges faced by a significant portion of the community amidst the recent price fluctuations. SHIB market cap currently at $4.8 billion. Chart: TradingView.com Selloff Pressure As Shibarium Launch Timeline Faces Uncertainty Meanwhile, recent data obtained from Etherscan reveals a noteworthy development within the Shiba Inu ecosystem. In a span of just a few hours, a substantial quantity of nearly 280 billion SHIB tokens, worth approximately $2,360,220, has been transferred to a Huobi wallet. This significant influx of tokens suggests a potential intention to sell them, putting additional downward pressure on the SHIB price. UNDERSTAND – if some testing goes wrong it may take longer – it’s being built – it’s not made from magic box😜 — 𝐋𝐔𝐂𝐈𝐄 (@LucieSHIB) May 24, 2023 The Shiba Inu team also faces another challenge regarding the launch of their much-anticipated Shibarium. In a recent tweet, @LucieSHIB, the official content marketing expert representing the Shiba Inu team, provided an update on the anticipated launch of Shibarium, the project’s Layer 2 network. Based on information shared by a SHIB developer known as Shibarium1, @LucieSHIB expressed her expectation that Shibarium could potentially be launched later this year, specifically in the third quarter. -Featured image from The Live Nagpur