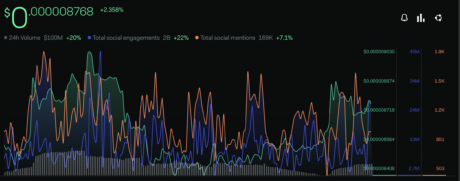

BAND Protocol Prices Stabilize After 40% Plunge: Will These Key Developments Help?

BAND prices remain stable at the time of writing. However, considering recent development within the Band Protocol ecosystem, there could be more upsides as the project unveils new features and strikes strategic partnerships. Horizen Partnership Recently, Band Protocol, a platform focusing on cross-chain data oracles, partnered with Horizen, a public blockchain offering a scalable ecosystem for decentralized applications (dapps). The goal is to provide EON, Horizen’s recently launched EVM-compatible intelligent contracting platform, with access to decentralized oracle services. In this way, decentralized finance (DeFi), gaming, and non-fungible tokens (NFTs) within the EON ecosystem will have real-time pricing information and reliable data via Band Protocol’s middleware solutions. Related Reading: Monaco, NFTs, And Formula 1: Reasons Polygon Is Bullish EON uses Band Protocol’s primary Oracle solution to provide real-time token price feeds across several blockchain networks. Integrating these two platforms ensures the integrity of EON’s data, which will be essential in developing the company’s DeFi, gaming, and NFT ecosystem. Band Protocol’s ability to gather and integrate real-world data and APIs to intelligent contracts may help EON become less reliant on centralized oracles, which introduce points of failure. This new link allows programmers to enhance and expand the functionality of EON intelligent contracts. According to Rob Viglione, co-founder, and CEO of Horizon Labs, the relationship with Band Protocol is a broad step forward in the company’s efforts to provide a safe and scalable environment for DApps. The reliable oracle services provided by Band Protocol allow programmers to design innovative software for DeFi, gaming, and NFTs. Integrating Band Protocol’s oracle solution, Horizen EON can now provide their intelligent contracts with accurate, real-time price data. Due to this collaboration, new possibilities in DeFi, gaming, and NFT applications will emerge, and the whole blockchain ecosystem will become more robust and decentralized. Band Protocol Planning For SubDAOs Moreover, Band Protocol has proposed the implementation of SubDAOs. According to Shine Sutheeravet, head of operations at Band Protocol, the goal is to address challenges in decentralized autonomous organizations (DAOs). SubDAOs offer solutions for complexity management, efficient resource allocation, specialized expertise, flexibility, inclusivity, and scalability. The proposal suggests transforming the Cosmos Group module into councils to establish clear governance structures. Related Reading: European Commission To Present Regulatory Framework For Digital Euro In June At the moment, Band Protocol is seeking community feedback to refine and optimize this governance framework and drive the growth of the SubDAO ecosystem. Amid this development, BAND prices are stable at around $1.39, and likely to recover after dropping 40% from February 2023 highs. -Featured Image From Canva, Chart From TradingView