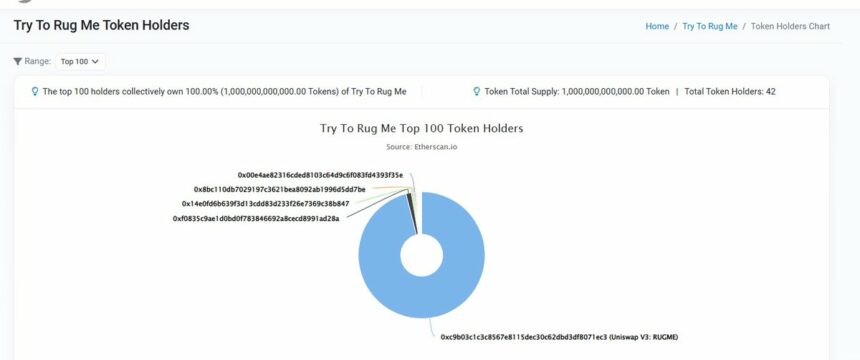

A new token has emerged in the cryptocurrency world, causing a stir among investors. Rug Me (RUGME) has a unique liquidity mechanism that is daring investors to try to “rug” the contract. According to the DeFi researcher Tsubasa, this high-stakes competition has a big brain game that challenges the most intelligent investors to solve a complex puzzle, promising high rewards. However, there is a catch. If someone is smart enough to solve the puzzle, they can rug the liquidity and take 20% of the pool. “Rugging” the liquidity means that someone can pull out a significant amount of funds from the pool and cause the token’s value to drop rapidly. This can result in significant losses for investors who hold the token. Related Reading: Polkadot Experiences Correction After Reaching $5.54: What’s Next In Store? RUGME, Big Brain Game, Or Big Risk? RUGME has a 1 trillion supply, with 100% used as liquidity. The token has a 10% transfer and buy fee, with no selling fee. All fees are disbursed to holders, who can claim them from the contract. When the liquidity is rug-pulled, 20% goes to the rugger, and 80% is refunded to the holders. Furthermore, Tsubasa believes investing in Rug Me is not for the faint. The token is high-risk and high-reward, with the potential for significant loss. But Rug Me (RUGME) offers a unique and exciting investment opportunity for investors willing to take risks. Investors are flocking to RUGME, with 15 ETH already in the liquidity pool. The token has a 100e curve, meaning that any buy below 100e will get the same price, with no first-comer advantage. The token has a 10% transfer and buy fee, with all fees disbursed to holders who can claim from the contract. This mechanism incentivizes holding the token, as holders can earn fees every time the token is transferred or bought. Investors can enter the market at the same price point as others below 100e, eliminating the issue of joining later to this market. The earlier investors are, the more fees they earn from buys. However, after 100e, the price will start moving, and if people keep buying, the price could skyrocket. But the risk of rug-pulling is ever-present, and investors need to know the potential for loss. Is The Memecoin Craze Losing Steam? Signs Point To A Slowdown Despite the launch of this new project, the meme coin sector is declining. he Pepe (PEPE) token, a meme-inspired cryptocurrency, recently experienced a surge in popularity that saw its price skyrocket from $0.00000002764 on April 17 to a high of $0.000004354 on May 5. However, the frenzy has cooled considerably, leaving many investors wondering if the Pepe (PEPE) craze is over. Currently, the token is trading at $0.0000014390, Down by 1% in the last 24 hours and more than 7% in the seven-day time frame. According to data from CoinGecko, the price of Pepe (PEPE) has fallen by more than 63% from its all-time high on May 5. Additionally, the daily transaction volume, which peaked at over $1 billion, has dropped to $270 million over the last 24 hours. Onchain data reveals a significant decline in interest in PEPE as the frenzy appears to end. Related Reading: No All-Time High For Bitcoin In 2023, Former BitMEX Head Arthur Hayes Predicts While the recent surge in popularity of meme-inspired cryptocurrencies like Pepe has captured the attention of investors, there are concerns about the sustainability of these coins. Many of them are highly speculative investments, and the recent drop-off in interest in Pepe (PEPE) seems to indicate that the hype may have been short-lived. Featured image from Unsplash, chart from TradingView.com