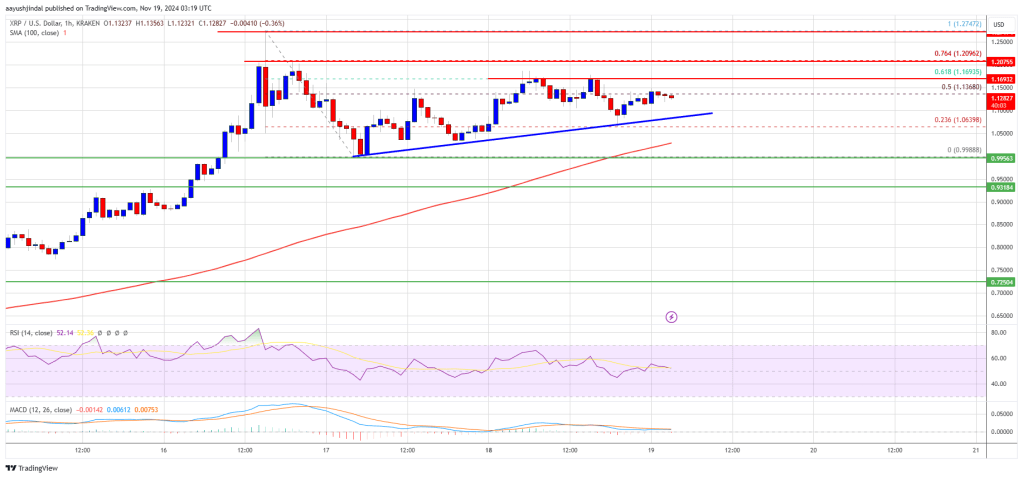

Tom Lee, the head of research at independent financial analysis firm Fundstrat, has reiterated his optimistic outlook for the Bitcoin price, predicting that the cryptocurrency is on track to reach the $100,000 mark before the year concludes. Optimistic Bitcoin Price Outlook In a recent appearance on CNBC’s Squawk Box, Lee discussed the implications of the political landscape following Donald Trump’s victory over Kamala Harris in the presidential election, suggesting that Bitcoin could play a pivotal role in the upcoming administration. Lee articulated that Bitcoin could serve as a solution to some of the United States’ fiscal challenges, particularly if it is designated as a national reserve asset—a promise made by Trump earlier this year at the National Bitcoin Conference in Nashville. Related Reading: Trump Social Media Firm In Talks To Expand Into Crypto With Bakkt Acquisition The Fundstrat executive also highlighted Bitcoin’s robust security features and its underlying blockchain technology, arguing that these elements position it as a viable alternative to some existing financial structures. Lee believes that Bitcoin’s attributes could address several issues inherent in the current economic framework, further boosting its appeal among investors. When discussing his price forecast, Lee expressed confidence, stating, “I think comfortably over $100,000 makes sense before the end of the year.” Lee noted that the current Bitcoin price trajectory is consistent with historical patterns observed during previous Halving cycles, events that typically reduce the rate at which new BTC are created and ultimately have a positive impact on price action. Key Support Levels Identified Crypto analyst Ali Martinez also provided insights into the current Bitcoin price price dynamics, but drawing parallels with historical market behavior. He noted that during the 2017 bull market, Bitcoin surged by 156% beyond its previous all-time high before experiencing a significant correction of -39%. Similarly, in 2020, Bitcoin rose 121% prior to a -32% pullback. Based on these patterns, Martinez suggests that Bitcoin could potentially reach at least $138,000 before facing its first major correction. Further analyzing past trends, Martinez pointed out that after Bitcoin broke its previous all-time high of $19,700 in 2020, it initially surged by 26%, consolidated for about a week, and then jumped to $40,000. Currently, Bitcoin has increased by 28% after surpassing its previous all-time high and has been consolidating for the past six days, leading Martinez to speculate that history might be repeating itself. However, he also cautioned that Bitcoin could be on the verge of a steep correction. He highlighted a growing sense of greed among crypto enthusiasts as evidenced by a notable spike in Google search interest for Bitcoin, reflected in the profits realized by investors, who have collectively taken home over $5.42 billion. Related Reading: MicroStrategy Makes Record $4.6 Billion Bitcoin Purchase, Largest Yet From a technical analysis standpoint, Martinez flagged the TD Sequential indicator, which has presented a sell signal on Bitcoin’s daily chart. Additionally, the Relative Strength Index (RSI) suggests that Bitcoin is currently in overbought territory, signaling potential for a price pullback. In the event of a correction, Martinez identified key support levels to monitor, specifically between $85,800 and $83,250, as well as further down at $75,520 to $72,880. The analyst emphasized that for a bullish outlook to remain intact, the Bitcoin price needs to maintain a sustained daily close above $91,900. Such a close could invalidate the bearish sentiment and potentially trigger a breakout toward a target of $100,680. As of this writing, the leading digital asset is trading at $90,970, up nearly 2% in the 24-hour time frame. Featured image from DALL-E, chart from TradingView.com