I bought $1k of the Top 10 Cryptos on January 1st, 2022 (FEB Update/Month 2)

|

EXPERIMENT – Tracking Top 10 Cryptos Of 2022 – Month Two – Down -14% Find the full blog post with all the tables here. Welcome to your monthly no-shill data dump: Here's the second monthly report for the 2022 Top Ten Experiment featuring BTC, ETH, BNB, SOL, ADA, USDC, XRP, LUNA, DOT, and AVAX. tl;dr

Month Two – Down -14%The 2022 Top Ten Crypto Index Fund Portfolio is BTC, ETH, BNB, Solana, ADA, USDC, XRP, LUNA, DOT, AVAX. February highlights for the 2022 Top Ten Portfolio:

February Ranking and DropoutsHere’s a look at the movement in the ranks two months into the 2022 Top Ten Index Fund Experiment: February Winners and LosersFebruary Winners – LUNA easily outperformed the pack this month, gaining an impressive +73% this month. XRP finished a distant second place, +27% in February. February Losers – SOL and ADA struggled to keep up with their peers this month, dropping -12% and -10% respectively. Overall Update – 80% of 2022 Top Ten in the red, LUNA with early lead, SOL worst performingLUNA’s had a wild ride this year already. Down -41% last month, it roared back in February and is now the only crypto (besides USDC) in positive territory. At the bottom is SOL, down -43% since the beginning of the year. The initial $100 invested in SOL sixty days ago is worth $57 today. Factoring in USDC GainsNew feature this year! – In past Experiment years, I have not included stablecoin gains in the monthly reports. These days, there are many ways to earn ROI using stables alone. I figure this may be especially interesting this year, depending on how the crypto market performs. For the 2022 Top Ten Experiment, I am detailing ways to build on the $100 USDC, starting with the most straightforward strategies. As we go along in the year, I will share increasingly advanced methods to increase USDC. My goal of this little side quest will be to beat the ROI of as many of the non-stablecoin cryptos in the Experiment as possible. A simple task if 2022 ends up being a bear year, a bit more difficult if the crypto market moons. February – One of the easiest methods to capitalize on stables (or any crypto for that matter) is to take advantage of sign up bonuses of different platforms, which are all competing for your business. Many of which can be triggered with a small initial investment. This month I took advantage of Nexo’s sign up bonus. Using a promo code I transferred my current balance of USDC and after 30 days was given $25 in BTC, which I immediately exchanged to USDC. These promo codes are everywhere online (or just ask a friend). A very easy 23% monthly gain. I am now +37% on USDC in two months. Something to be aware of: If you're considering taking advantage of this bonus, there have been complaints that Nexo doesn’t pay the $25 bonus if the value of the crypto you transfer is worth under $100 at the end of 30 days, as per the terms and conditions. Lucky for us we’re using USDC, so I had no problem with the bonus. 2022 Top Ten Portfolio vs. Total Crypto Market Cap Token (TCAP)Another new feature this year! – The first Top Ten Crypto Experiment was started on 1 February 2018 in an attempt to capture the gains of the entire market. Much has changed in the last four+ years, including innovative Decentralized Finance (DeFi) projects that have created index tokens to capture segments of the crypto market (DeFi, the Metaverse, Blue Chips, etc.) instead of manually buying coins and tokens, like I do for my Experiments. A project of particular interest to the Top Ten Experiments is the Total Crypto Market Cap (TCAP) token, created by Cryptex, which tracks the entire crypto market – exactly what my Top Ten Portfolios have been trying to recreate from the start. I thought it would be interesting to compare my homemade 2022 Top Ten Crypto Index Fund Experiment to TCAP for a bit of a friendly competition. Here’s the question I’ll be tracking this year: would I have been better off with $1,000 of TCAP instead of going through the effort of creating a homemade $1,000 Top Ten Index Fund? February: Thanks to a strong month, both the TCAP token and the 2022 Top Ten Portfolio gained in value. The February monthly victory goes to the 2022 Top Top Portfolio (+14%) which edged out TCAP’s +11% gain Overall: TCAP leads the 2022 Top Ten Portfolio. Visual below: Bitcoin Dominance:BitDom continued to tick up this month, ending February at 43.3%. For context, it was at 40.2% at the beginning of the year. For those just getting into crypto, it’s worth paying attention to the Bitcoin dominance figure, as it signals the appetite for altcoins vs. BTC. Overall return on $1,000 investment since January 1st, 2022:The 2022 Top Ten Portfolio gained $100 in February. The initial $1000 investment on New Year’s Day 2022 is now worth $862, down -14%. Here’s a visual summary of the progress so far: The 2022 Top Ten Cryptos are currently the worst performing of the five Portfolios. Combining the 2018, 2019, 2020, 2021, and 2022 Top Ten Crypto PortfoliosSo, where do we stand if we combine five years of the Top Ten Crypto Index Fund Experiments?

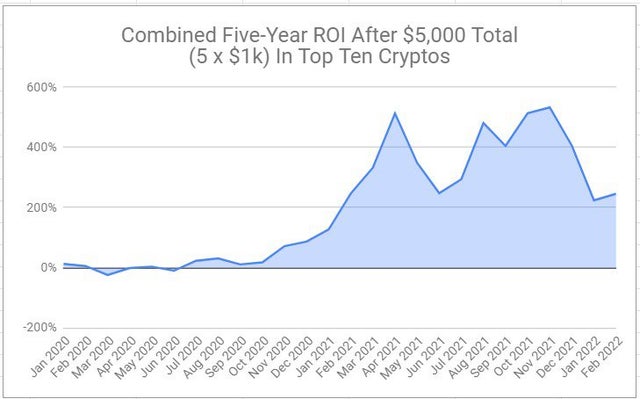

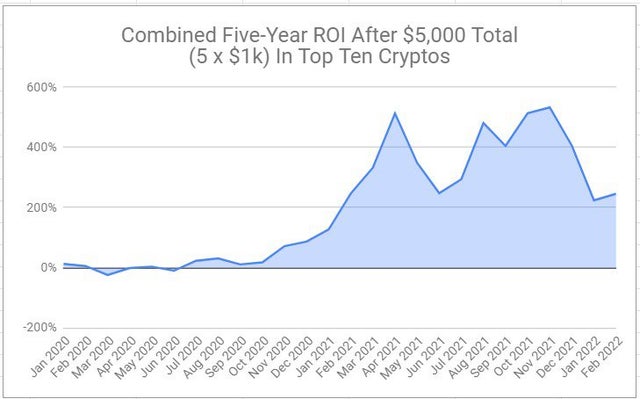

Taking the five portfolios together, here’s the bottom bottom bottom bottom bottom line: After a $5,000 investment in the 2018, 2019, 2020, and 2021 Top Ten Cryptocurrencies, the combined portfolios are worth $17,332. That’s up +247% on the combined portfolios, down from November 2021’s all time high for the Top Ten Index Fund Experiments of +533%. Here’s the combined monthly ROI since I started tracking the metric in January 2020: In summary: That’s a +247% gain by investing $1k on whichever cryptos happened to be in the Top Ten on January 1st (including stablecoins) for five straight years. Comparison to S&P 500I’m also tracking the S&P 500 as part of my Experiment to have a comparison point to traditional markets. The S&P 500 is down -10% so far in 2022, so the initial $1k investment into crypto on New Year’s Day would be worth $900 had it been redirected to the S&P. Taking the same invest-$1,000-on-February-1st-of-each-year approach with the S&P 500 that I’ve been documenting through the Top Ten Crypto Experiments, the yields are the following:

Taken together, here’s the bottom bottom bottom bottom bottom line for a similar approach with the S&P: After five $1,000 investments into an S&P 500 index fund in January 2018, 2019, 2020, and 2021, my portfolio would be worth $6,710. That is up +34% since January 2018 compared to a +247% gain of the combined Top Ten Crypto Experiment Portfolios. Here’s a fancy new chart showing a combined ROI comparison between a Top Ten Crypto approach and the S&P as per the rules of the Top Ten Experiments: Conclusion:To the long time followers of the Top Ten Experiments, thank you so much for sticking around so long. For those just getting into crypto, I hope these reports will help prepare you for the highs and lows that await on your crypto adventures. Buckle up, go with the flow, think long term, don’t invest what you can’t afford to lose, and most importantly, try to enjoy the ride! A reporting note: I’ll focus on 2022 Top Ten Portfolio reports + one other portfolio on a rotating basis this year, so expect only two reports from me per month. February’s extended report was on the 2019 Top Ten Portfolio, which you can access here. You can check out the latest 2018 Top Ten (the OG Experiment), 2020 Top Ten, and 2021 Top Ten reports as well. submitted by /u/Joe-M-4 |