$1k invested into the Top Ten Cryptos in January 2021 – UP +387% (NOV Update – Month 11)

|

EXPERIMENT – Tracking Top 10 Cryptos Of 2021 – Month Eleven – UP 387% Full blog post with all the tables here. January 1st, 2021, I bought $100 of following and turned it into a homemade crypto index fund: Bitcoin, Ethereum, Tether, XRP, Litecoin, Polkadot, Bitcoin Cash, Cardano, Binance Coin, and Chainlink. Below is the eleventh monthly update on the progress of the 2021 Experiment. tl;dr:

Month Eleven – UP 387%The 2021 Top Ten Crypto Index Fund consists of: BTC, ETH, USDT, XRP, Litecoin, DOT, BCH, ADA, BNB, and LINK. November highlights for the 2021 Top Ten Portfolio:

November Ranking and Dropout ReportTop Ten dropouts since January 2021: Eleven months into the 2021 Top Ten Experiment, three cryptos have dropped out: Chainlink, Litecoin, and Bitcoin Cash. They have been replaced by SOL, DOGE, and USDC. November Winners and LosersNovember Winners – BNB had the best month, by far, finishing November +18%. November Losers – DOT got hammered this month, losing -22% of its value. ADA also had a tough November, down -19%. Tally of Monthly Winners and LosersEleven months into the Experiment, here’s where we stand in terms of the 2021 Top Top Portfolio’s monthly winners and losers: ADA and BNB are in the lead with three monthly victories each. ADA has the most monthly losses. Overall Update – BNB pulls away from the field, all cryptos in green, BCH worst performingAfter a year of back and forth between BNB and ADA, Binance Coin has left Cardano and the rest of the cryptos in this portfolio well behind. The $100 investment into first place BNB eleven months ago is now worth $1,654. Besides Tether, BCH is the worst performing cryptocurrency of the 2021 Top Ten Portfolio, up +64% in 2021. Total Market Cap for the Entire Cryptocurrency Sector:As a sector, crypto is up +241% in the eleven month lifespan of the 2021 Top Ten Experiment. You may notice that the 2021 Top Ten Portfolio has produced better returns than the overall crypto market cap (+387% vs. +241%) so far in 2021. This is a bit of an outlier and the gap is closing: the rest of the Top Ten Experiments are well behind over their respective time frames. Although the 2021 Top Ten approach has held up quite well compared to the overall market so far, I expect to see it fall behind eventually, like the other experiments. Crypto Market Cap Low Point in the 2021 Top Ten Crypto Index Experiment: $775B in January 2021. Crypto Market Cap High Point in the 2021 Top Ten Crypto Index Experiment: $2.6T last month. Bitcoin Dominance:BitDom fell in November, ending the month at 40.7% (compared to 43.7% in October). This is a new low when looking at the 2021 timeframe as a whole. BitDom Low Point in the 2021 Top Ten Crypto Index Experiment: 40.7% this month. BitDom High Point in the 2021 Top Ten Crypto Index Experiment: 70.4% in January 2021. Overall return on $1,000 investment since January 1st, 2021:The 2021 Portfolio dropped $121 in November. Overall, the 2021 Top Ten Portfolio is up +387%, the initial $1000 investment on New Year’s Day 2021 worth $4,866. Here’s the month by month ROI of the 2021 Top Ten Experiment, to give you a sense of perspective and provide an overview as we go along: The 2021 Top Ten Portfolio has had the best start, by far, of any of the four Top Ten Crypto Experiments. Combining the 2018, 2019, 2020, and 2021 Top Ten Crypto PortfoliosAs most readers are aware, this is the fourth year of an Experiment I started back in January of 2018, at the height of the last crypto bull run. Where do we stand if we combine four years of the Top Ten Crypto Index Fund Experiments?

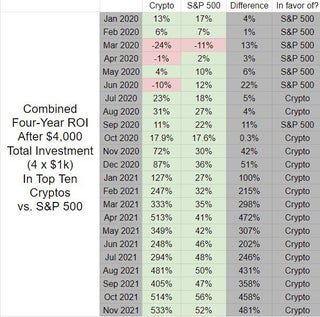

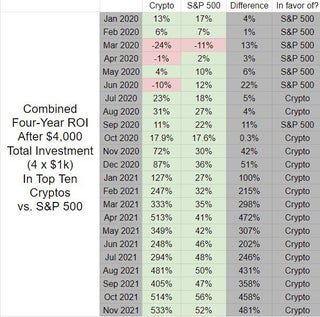

So overall? Taking the four portfolios together, here’s the bottom bottom bottom bottom line: After a $4,000 investment in the 2018, 2019, 2020, and 2021 Top Ten Cryptocurrencies, the combined portfolios are worth $25,340 ($1,666 + $7,645 + $11,160 + $4,866). That’s up +533% on the combined portfolios, a second straight all time high for the Top Ten Index Fund Experiment. Here’s a table to help visualize the progress of the combined portfolios: In summary: That’s a +533% gain by investing $1k on whichever cryptos happened to be in the Top Ten on January 1st (including stablecoins) for four straight years. Comparison to S&P 500I’m also tracking the S&P 500 as part of my experiment to have a comparison point to traditional markets: The S&P 500 Index is up 20% in 2021. The initial $1k investment I put into crypto nine months ago would be worth $1,200 had it been redirected to the S&P 500. The 2021 Top Ten Crypto Portfolio is up +387% over the same time period – the initial $1k investment in crypto nine months ago is now worth $4,866. That’s a difference of $3,666 on a $1k investment in eleven months. What about in the longer term? What if I invested in the S&P 500 the same way I did during the first four years of the Top Top Crypto Index Fund Experiments? What I like to call the world’s slowest dollar cost averaging method? Here are the figures:

Taken together, here’s the bottom bottom bottom bottom line for a similar approach with the S&P: After four $1,000 investments into an S&P 500 index fund in January 2018, 2019, 2020, and 2021, my portfolio would be worth $6,090 ($1,690 + $1,800 + $1,400 + $1,200) That is up +52% since January 2018 compared to a +533% gain of the combined Top Ten Crypto Experiment Portfolios, a difference of 481 percentage points in favor of crypto. To help provide perspective, here’s a quick look at the combined four year ROI for crypto vs. the S&P up to this point. Conclusion:To the long time followers of the Top Ten Experiments, thank you so much for sticking around so long. For those just getting into crypto, I hope these reports will help prepare you for the highs and lows that await on your crypto adventures. Buckle up, go with the flow, think long term, don’t invest what you can’t afford to lose, and most importantly, try to enjoy the ride! Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for my parallel projects tracking the Top Ten cryptos as of January 1st, 2018 (the OG Experiment), January 1st, 2019, and January 1st, 2020. submitted by /u/Joe-M-4 |